As May 2025 concludes, the cryptocurrency landscape is marked by significant institutional investments, evolving regulatory frameworks, and technological advancements. These developments are reshaping the digital asset ecosystem, offering both opportunities and challenges for investors.

Bitcoin and Ethereum Face Volatility

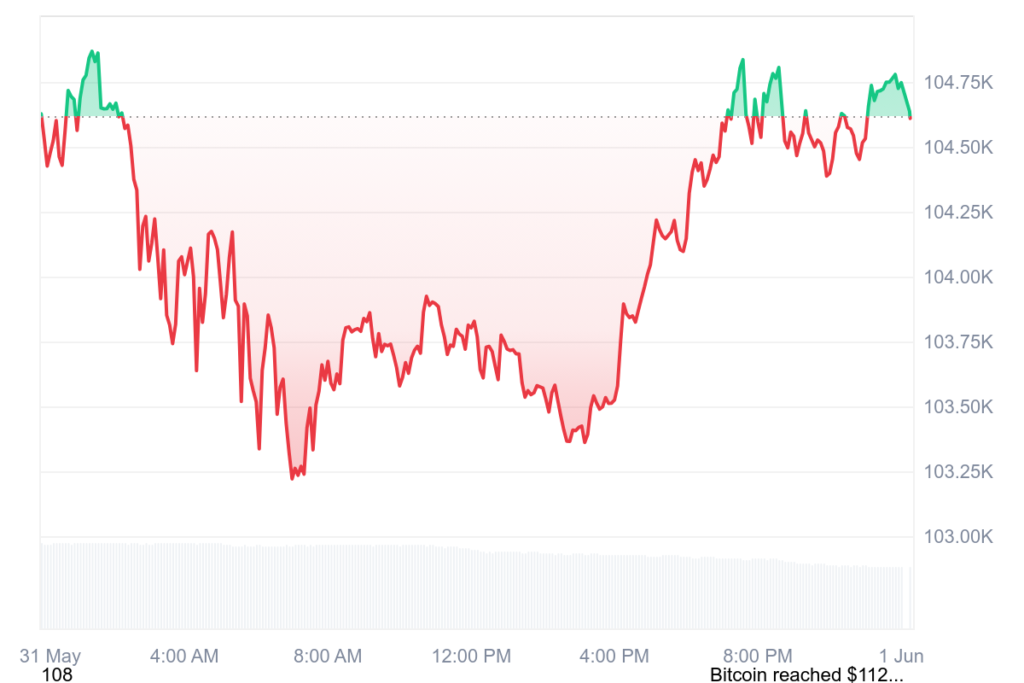

Bitcoin (BTC) experienced a decline, trading below $106,000, influenced by geopolitical tensions and macroeconomic uncertainties. As of May 30, BTC was priced at $105,857, with an intraday low of $104,684. The overall crypto market capitalization decreased by 2.12%, settling at $3.34 trillion .

Ethereum (ETH) mirrored this trend, trading at $2,540.90, down 1.45% from the previous close. The intraday high and low were $2,542.94 and $2,494.41, respectively.

Institutional Engagement: U.S. Embraces Digital Assets

In a landmark move, President Donald Trump signed an executive order establishing the Strategic Bitcoin Reserve, positioning the U.S. as the largest state holder of Bitcoin with approximately 207,189 BTC. Simultaneously, major U.S. banks, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are collaborating on a “digital dollar” stablecoin, aiming to modernize the payment infrastructure .

Trump Media & Technology Group announced plans to raise $2.5 billion to invest in Bitcoin, further intertwining political and financial interests in the crypto space.

UK’s Reform Party Accepts Crypto Donations

Nigel Farage’s Reform UK party has become the first in the UK to accept cryptocurrency donations, including Bitcoin. The party also proposes a cryptoassets and digital finance bill aimed at reducing capital gains tax on crypto from 24% to 10% and establishing a Bitcoin reserve at the Bank of England .

The Guardian

Emerging Markets: Pakistan’s Strategic Bitcoin Reserve

Pakistan launched its first government-led Strategic Bitcoin Reserve, allocating 2,000 megawatts of surplus electricity for Bitcoin mining and AI data centers. This initiative is part of the country’s broader strategy to integrate blockchain technology into its financial landscape.

Global Regulatory Developments

European Union: The Markets in Crypto-Assets (MiCA) regulation became fully applicable in December 2024, providing a comprehensive framework for crypto asset regulation across EU member states .

United States: The revised GENIUS Act introduces stringent measures for stablecoins, including audits and anti-money laundering protocols, reflecting a growing emphasis on consumer protection and regulatory compliance .

Technological Advancements in AI and Tokenization

Artificial Intelligence (AI) is increasingly influencing the crypto sector, with AI agents managing over $100 billion in decentralized finance (DeFi) activities. These agents optimize trades, manage yield farming strategies, and handle portfolio management, enhancing efficiency and fostering innovation .

Tokenization of real-world assets, such as real estate and commodities, is gaining traction, enabling fractional ownership and enhancing liquidity. This trend is expected to drive significant growth in the cryptocurrency market cap, with projections reaching $3.4 trillion by the end of 2025 .

KuCoin

UAE’s Crypto-Friendly Environment

The United Arab Emirates continues to attract crypto investors due to its favorable tax conditions and progressive regulatory environment. The absence of taxes on cryptocurrency gains and the issuance of licenses to platforms like Crypto.com to offer derivatives contribute to the UAE’s status as a leading destination for crypto investment .

Navigating the Evolving Crypto Landscape

May 2025 has been a pivotal month for the cryptocurrency sector, marked by increased institutional adoption, significant regulatory developments, and technological innovations. Investors should stay informed and adaptable to navigate the dynamic and evolving digital asset ecosystem.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.