In a groundbreaking leap for real-world asset (RWA) tokenization, Backed Finance has just launched xStocks, a tokenized stock trading ecosystem now live on Kraken, Bybit, and top Solana DeFi platforms. This major move bridges the world of traditional equities and decentralized finance, giving global crypto users access to 60+ top-tier U.S. stocks and ETFs—all on-chain.

From Apple (AAPL) to Tesla (TSLA), Amazon (AMZN) to Netflix (NFLX), and even Coinbase (COIN) itself, tokenized shares are now accessible 24/7, commission-free, and with the power of blockchain-backed settlement.

Stocks, But Make It Crypto: What’s the Buzz?

Tokenized stock trading isn’t new, but this time it’s different—and the crypto markets know it. Unlike previous short-lived attempts, this rollout is fully asset-backed, regulation-aligned, and deeply integrated into DeFi rails.

Each tokenized equity is a 1:1 representation of a real-world share, held in regulated custody by Backed Finance in Switzerland. And these are no “synthetic” copies—they’re redeemable for the real deal, ensuring transparency and trust.

The best part? All this is happening on Solana, one of the fastest and cheapest Layer 1 chains. That means instant swaps, liquidity pools, DeFi composability, and yield farming—with stocks.

Kraken and Bybit Say “Stock Up”

Crypto giants Kraken and Bybit are the first major exchanges to list these tokenized stocks. Here’s what you can expect:

- 24/7 trading — No more waiting for Wall Street hours.

- No commission fees — Trade stocks like crypto.

- Phantom wallet integration — Store tokenized stocks in your Solana wallet.

- Global access — Available to most regions (except U.S. residents due to regulations).

Bybit confirmed it’s operating under the EU MiFID II framework, signaling strong compliance, while Kraken has emphasized its focus on DeFi-native investors looking for off-ramp equity exposure.

From DeFi Degen to Wall Street Whales

This isn’t just stock trading with a twist—it’s DeFi’s new utility layer. These tokenized stocks aren’t locked to centralized exchanges—they’re free to roam across the Solana DeFi landscape.

Already, platforms like:

- Kamino allow users to earn yield by supplying xStocks into liquidity pools.

- Jupiter enables single-click swapping between stablecoins and tokenized equities.

- Raydium supports liquidity farming and potential yield boosts through staking these RWAs.

Think of it as yield farming Netflix, or using Tesla shares as collateral for crypto loans. This kind of fusion wasn’t possible before—and it just might redefine what “investing” looks like in 2025.

DFDVx: First Public Company Tokenizes on Solana

The signal couldn’t be clearer: TradFi is moving on-chain.

DeFi Development Corp (NASDAQ: DFDV) has become the first publicly traded U.S. company to tokenize its equity via the xStocks model. Dubbed DFDVx, the token will soon trade alongside blue-chip giants—bringing real-world shareholder value to the blockchain.

DFDV’s mission? Build a treasury dominated by SOL, and drive adoption through decentralized equity participation. With Kraken and Solana as launch partners, this isn’t a proof-of-concept—it’s a paradigm shift.

Why It Matters for Crypto Users

This evolution goes beyond speculation. It offers:

- Permissionless access to U.S. equities

- Composability with DeFi tools, protocols, and smart contracts

- Borderless investment for underbanked and over-regulated regions

- Potential passive income through liquidity provision and lending markets

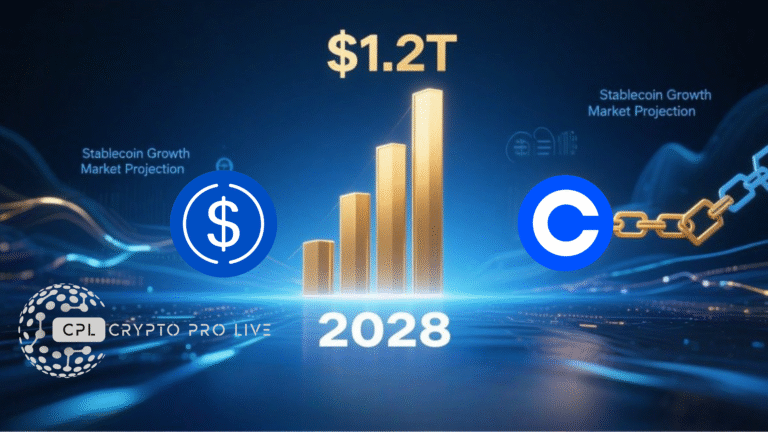

With analysts forecasting an $18.9 trillion market for real-world asset tokenization by 2033, this rollout might be remembered as the moment DeFi found its real utility.

Risks and Realities

Despite the bullish tone, this frontier isn’t without its challenges:

- Regulatory uncertainty: U.S. users remain blocked due to compliance barriers.

- Custodial trust: Token-to-asset conversion depends on third-party custodians.

- Liquidity fragmentation: Market depth may vary between DeFi and CEX venues.

Still, the momentum is hard to ignore. With Kraken, Bybit, Solana, and real-world companies involved, this isn’t a beta test—it’s a bridge to the future.

Final Word: “From Memecoins to Microsoft”

Crypto’s wild west has often been home to dog-themed tokens and hype-driven narratives. But with tokenized stocks going live, a new chapter begins: one where the average crypto wallet can hold Microsoft, Meta, or McDonald’s, just like it holds Ethereum or Solana.

This is more than convenience—it’s a structural shift in how markets work, who can access them, and what DeFi can do.

If the 2020s were the decade of crypto coins, 2025 might just be the beginning of crypto equities. And Backed Finance’s launch is writing the first lines.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.