Federal Reserve insiders believe Chairman Jerome Powell may have heavily invested in Ethereum (ETH) before adopting a dovish stance on markets. Amassing 118.5K views by 04:50 PM +04, the unverified claim has sparked speculation about the intersection of monetary policy and cryptocurrency adoption. Paired with ETH’s iconic logo, the post implies Powell’s recent remarks might have been influenced by personal stakes, though no concrete evidence supports this narrative.

Powell’s dovish comments, likely tied to interest rate expectations, have historically boosted risk assets, including crypto. If true, an Ethereum accumulation prior to this shift could suggest strategic foresight, leveraging the Fed’s influence on market sentiment. Ethereum, the backbone of decentralized finance and smart contracts, has seen renewed interest amid macroeconomic uncertainty. However, without official confirmation, this remains speculative, fueling debates about insider trading and regulatory oversight in the crypto space.

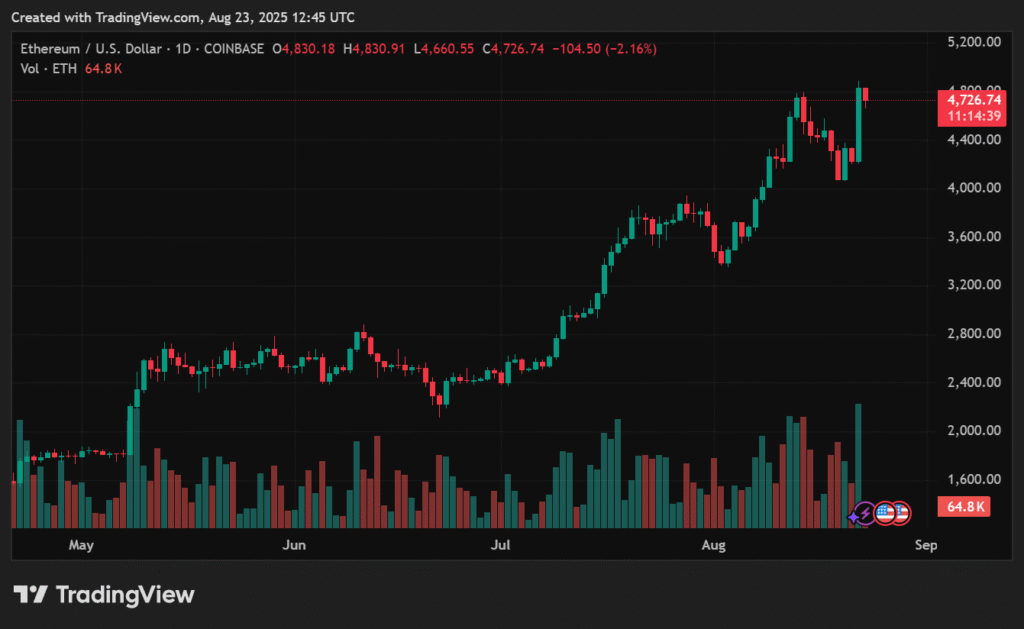

For investors, this rumor adds a layer of intrigue to ETH’s price action. A pre-dovish accumulation could signal confidence in Ethereum’s long-term value, potentially driving bullish momentum. Yet, the lack of substantiation raises red flags, urging caution. As of 04:50 PM +04 on August 23, 2025, ETH trades with heightened volatility, with traders eyeing Powell’s next moves for clues. The market’s reaction hinges on whether this narrative gains traction or fades as unproven gossip.

This speculation also highlights the growing scrutiny of high-profile figures in crypto markets. If Powell or Fed insiders hold significant ETH positions, it could prompt calls for transparency, impacting regulatory frameworks. Crypto enthusiasts should monitor official statements and on-chain data for validation. For now, the rumor serves as a reminder of the unpredictable forces shaping cryptocurrency, blending policy, perception, and profit potential.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.