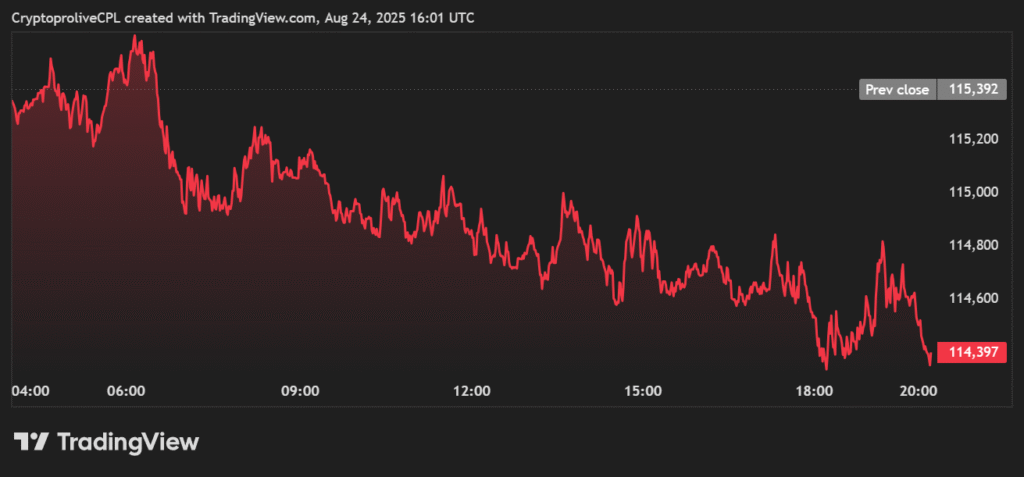

Michael Saylor’s bold Bitcoin investment strategy continues to pay dividends, with his portfolio now valued at an impressive $72.15 billion. The MicroStrategy co-founder and crypto advocate has long championed Bitcoin as a hedge against inflation, and the latest data from his portfolio tracker underscores this success. With a total cost of $6.29 billion for 214,413 BTC, Saylor’s holdings reflect an unrealized gain of $65.86 billion, a staggering 1,047% return. This performance, detailed in the chart from saylortracker.com, highlights a steady upward trajectory since his initial purchases in 2020, despite market volatility.

The chart reveals a strategic accumulation pattern, with orange dots marking purchase points and a green line tracking the total cost average. The blue line, representing the 8-hour market price, shows Bitcoin’s price surging past $140,000 in recent months, far exceeding Saylor’s average buy-in price. This growth aligns with a broader bull market, driven by institutional adoption and macroeconomic factors. Saylor’s unwavering commitment—acquiring BTC even during dips—has positioned MicroStrategy as a bellwether for corporate crypto investment.

However, this success isn’t without risks. Bitcoin’s volatility remains a concern, with sharp corrections possible in the near term. Analysts suggest that Saylor’s portfolio could face pressure if regulatory scrutiny intensifies or if macroeconomic conditions shift, such as rising interest rates. Despite this, his long-term vision appears vindicated, with the asset’s value more than doubling since the start of 2025.

For crypto enthusiasts, Saylor’s journey offers a blueprint for resilience. His portfolio’s performance reinforces Bitcoin’s narrative as “digital gold,” attracting both retail and institutional investors. As the market evolves, all eyes will be on whether Saylor continues his aggressive buying spree or locks in gains. For now, his $72.15 billion milestone stands as a testament to the power of conviction in the volatile world of cryptocurrency.