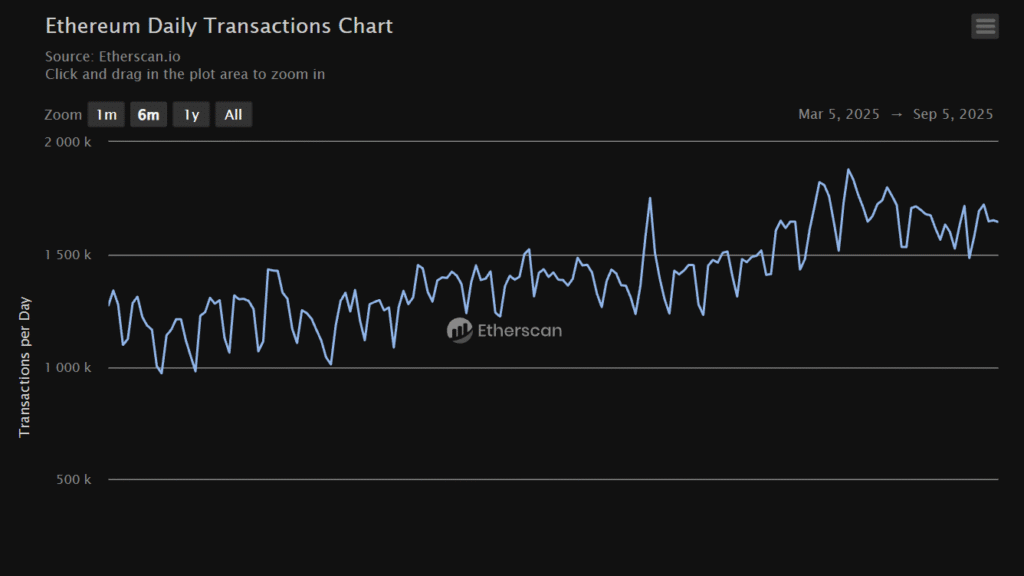

Ethereum has once again proven its resilience and dominance in the blockchain space. Since July 19th, 2025, the network has consistently processed at least 1.4 million transactions per day, according to data from Etherscan. This milestone not only underlines Ethereum’s strong adoption but also highlights its growing role as the backbone of decentralized finance (DeFi), NFTs, and Web3 applications.

Ethereum’s Steady Growth in On-Chain Activity

For years, Ethereum has been the leading smart contract platform, and this recent data reinforces its position. The six-week streak of sustained high transaction volume reflects increasing utility across multiple sectors:

DeFi protocols continue to attract users seeking decentralized trading, lending, and yield opportunities.

NFT markets, while less hyped than their 2021 peak, remain active and are gradually evolving with new use cases.

Layer 2 solutions such as Arbitrum, Optimism, and Base are offloading congestion from Ethereum mainnet while still contributing to on-chain settlements.

With Ethereum consistently handling such a high throughput, it signals healthy demand despite market volatility.

Why 1.4 Million Transactions Per Day Matters

Ethereum’s sustained transaction growth is more than just a number—it is a clear signal of long-term adoption. Here’s why it matters:

Network Resilience – Maintaining transaction volumes above 1.4M daily without major slowdowns or outages shows Ethereum’s scalability improvements, especially after upgrades like EIP-4844 (proto-danksharding).

Economic Activity – Higher transactions mean greater usage of ETH as gas, strengthening its position as a utility asset. Increased activity often correlates with higher fee burns, supporting Ethereum’s deflationary model.

Investor Confidence – Institutional and retail investors monitor on-chain data closely. Sustained high usage reinforces Ethereum’s relevance, boosting confidence in its long-term value proposition.

The Road Ahead for Ethereum

Looking forward, Ethereum’s challenge lies in balancing scalability with decentralization. While rollups and Layer 2s are alleviating congestion, the ecosystem must ensure security and interoperability across chains.

At the same time, Ethereum’s ability to consistently attract builders, developers, and users ensures its competitive edge against rivals like Solana, Avalanche, and newer ecosystems.

If Ethereum continues to process over 1.4M+ daily transactions, it will further cement its role as the settlement layer of the decentralized internet.

Ethereum’s transaction surge since July is more than just a statistical milestone—it’s a reflection of real adoption and real utility. While price movements often steal the spotlight, on-chain data tells the true story: Ethereum is not just surviving, it’s thriving.

As the network evolves with more scalability upgrades, Ethereum could easily see this 1.4M daily transaction baseline grow even further, driving both adoption and value for years to come.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.