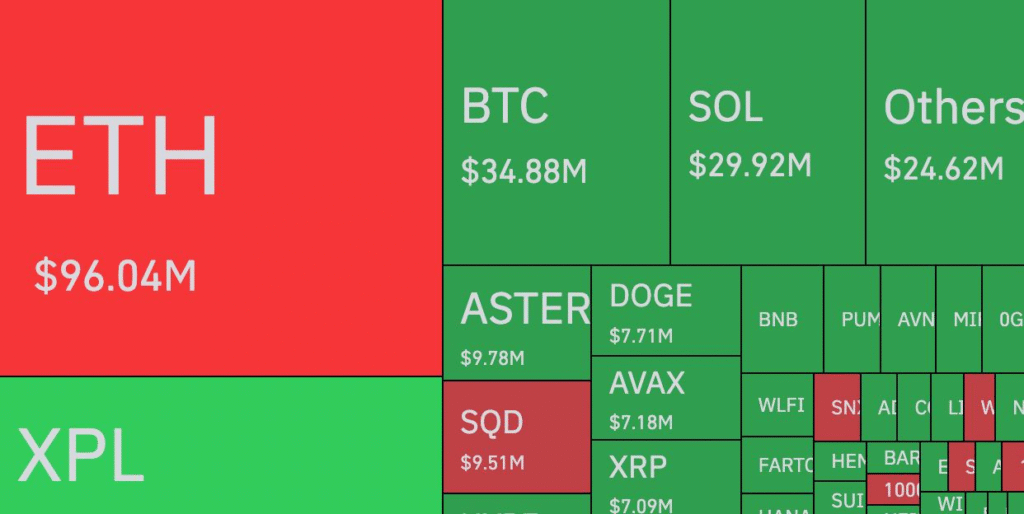

ETH leads with $96.04M in liquidations, signaling a major market correction.

Total liquidations hit $346M, with $200M from longs and $146M from shorts.

XPL and smaller tokens like SQD also face significant liquidation pressure.

The cryptocurrency market experienced a significant shakeup over the past 24 hours, with a staggering $346 million in liquidations rocking the trading landscape. According to the latest data visualized in a treemap, Ethereum (ETH) and XPL topped the liquidation charts, reflecting the volatile nature of the market as of 07:40 AM +04 on September 27, 2025. The liquidations included $200 million from long positions and $146 million from short positions, signaling a brutal correction that has left traders reeling.

ETH led the liquidation volume with $96.04 million, highlighted in red on the treemap, indicating a sharp decline that triggered massive stop-losses. XPL followed closely with a substantial $9.3 million, while other major players like Bitcoin (BTC) at $34.88 million and Solana (SOL) at $29.92 million also faced significant liquidations. The “Others” category, encompassing a diverse range of altcoins, contributed $24.62 million to the total, underscoring the widespread impact. Notably, smaller tokens like SQD ($9.51 million) and AVAX ($7.18 million) also saw red, hinting at a cascading effect across the board.

This liquidation event suggests a market correction following a period of over-leveraged positions. Long traders, who bet on price increases, bore the brunt with $200 million wiped out, while short sellers lost $146 million as prices fluctuated unexpectedly. The dominance of ETH and XPL in the liquidation figures points to heightened speculation around these assets, possibly driven by recent market sentiment or technical breakdowns. For seasoned traders, this serves as a stark reminder of the risks tied to high leverage, especially in a market prone to rapid shifts.

Looking ahead, the crypto community will be watching closely for signs of stabilization. The high liquidation volume could indicate an oversold condition, potentially setting the stage for a rebound if buying pressure returns. However, it also raises concerns about the sustainability of current market trends. As always, diversification and risk management remain critical, with this event reinforcing the need for cautious strategies amid ongoing volatility.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.