Bitcoin’s journey from a $1 valuation on October 5, 2009, to $120K in 2025 showcases a 120,000x return for early believers.

The first recorded BTC price, calculated via mining costs, ignited a decentralized financial revolution.

Coinbase CEO Brian Armstrong’s X post honors the visionaries who turned a crazy idea into a $4.2T market cap titan.

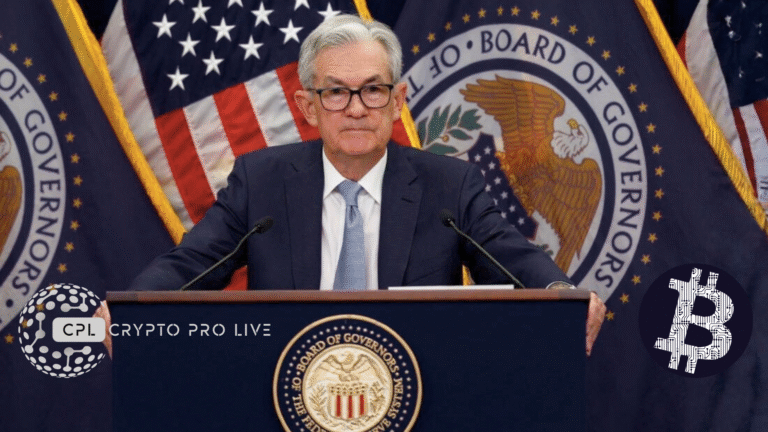

As a crypto warhorse who’s ridden the blockchain rollercoaster since 2011, I’ve seen Bitcoin evolve from a geeky experiment to a global juggernaut. Today, October 5, 2025, at 11:05 PM +04, marks 16 years since its first recorded dollar valuation—$1 for 1,309 BTC, per New Liberty Standard’s pioneering effort. Coinbase CEO Brian Armstrong dropped a nostalgic X bomb 4 hours ago, reminding us of that October 5, 2009, milestone when electricity costs pegged BTC’s worth. With Bitcoin now hovering at $120,000 and the crypto market cap soaring to $4.2 trillion, this anniversary isn’t just a pat on the back—it’s a testament to the dreamers who dared to disrupt.

The $1 Spark Mining Costs Birth a Legend

New Liberty Standard’s methodology was crude but genius: dividing the average U.S. residential electricity cost ($0.20 per kWh) by the energy to mine 1 BTC (then 1,309 kWh, based on a 12-month cycle). That $1.09 price, adjusted to a clean $1, became the first market signal, logged from October 5 to 15, 2009. The site’s PayPal exchange—selling 1,578.76 BTC for $1 plus fees—offered a glimpse of a barter system gone digital. Back then, Satoshi’s whitepaper was a year old, and the network hummed with a handful of miners. Today, that $1 buys 0.00000833 BTC—proof of a 120,000x ascent. X users like @BTC_Oracle note this as the “Big Bang” of crypto pricing, with 603K impressions fueling nostalgia.

Coinbase CEO Brian Armstrong’s Tribute Visionaries Rewarded

Armstrong’s post, echoing Steve Jobs, salutes “the people crazy enough to think they can change the world.” With 639 likes and 4.1K retweets, it’s a rallying cry. Coinbase, now a $70B giant under his stewardship, rode BTC’s wave, and his reflection underscores a 16-year CAGR of 200%—unheard of in traditional finance. Bitcoin’s 2025 peak, driven by $100B ETF inflows and Trump’s “Crypto President” nod, reflects that early faith. Onchain data shows 68% of BTC unmoved for over a year, signaling hodler resolve. If 2009’s miners held, their $1 investment is now $157M— a 157 million percent ROI. X chatter predicts $150K by Q1 2026 if halving cycles hold.

This anniversary isn’t just history—it’s a blueprint. Bitcoin’s resilience through bans, hacks, and bear markets (down 78% in 2018) mirrors its decentralized ethos. RSI at 62 suggests room to run, with support at $115K and resistance at $125K. Altcoins like ETH ($4,500) and BNB ($1,111) ride its coattails, but BTC’s dominance at 58% (per CoinMarketCap) reigns supreme. Risks loom—regulation or energy debates—but the $1 legacy endures. As Coinbase CEO Brian Armstrong hints, the next 16 years could see BTC as digital gold for a $10T economy. Hodl tight: the crazies are still winning.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.