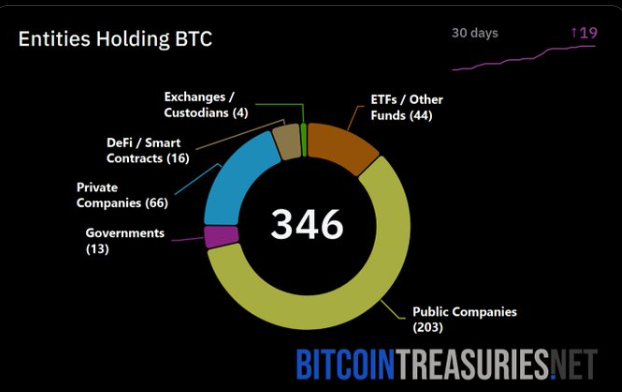

BTC Holders Hit 346 Record entities now stash Bitcoin in treasuries, surging 19 in the last 30 days.

Public Firms Lead Charge 203 public companies dominate, fueling $130B total holdings boom.

Uptober Ignition New adopters like Metaplanet signal supply squeeze—rally ahead or bubble alert?

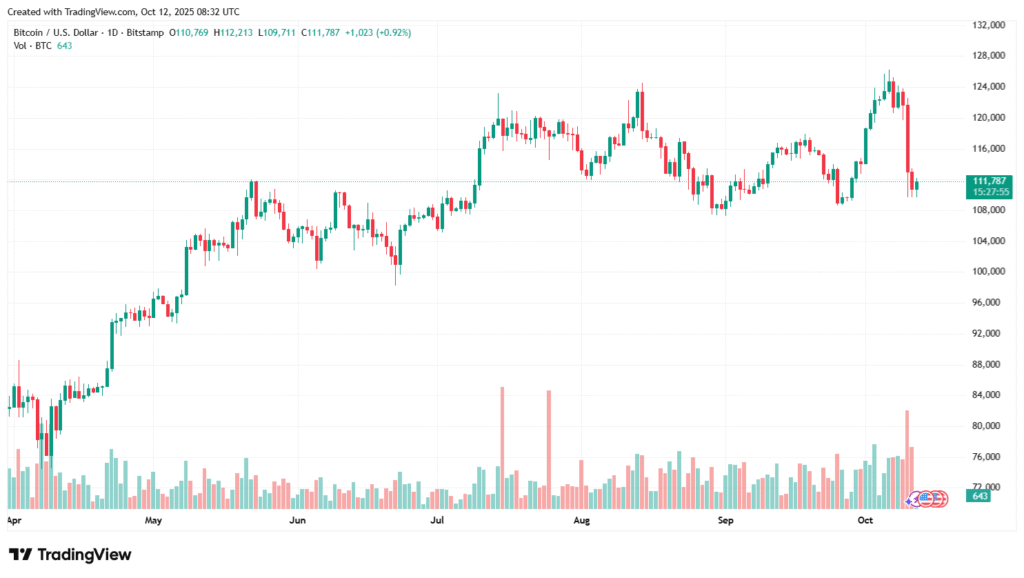

Bitcoin’s gravitational pull on global finance intensifies as adoption hits a record high. Data from BitcoinTreasuries.net reveals 346 entities now holding Bitcoin (BTC) in their treasuries, a sharp 19-entity increase over the past 30 days as of October 12, 2025. This eclectic group—from tech titans to sovereign states—collectively safeguards billions in BTC, underscoring the asset’s evolution from fringe speculation to core reserve strategy. With BTC trading near $100,000 in the heart of “Uptober,” this influx signals robust institutional confidence, yet it also amplifies debates on whether it’s a bull market bedrock or an overleveraged bubble waiting to pop.

The chart, shared via X by BitcoinTreasuries.net, paints a vivid picture: a pie slice of diversification amid a rising trend line, with total corporate holdings surpassing $130 billion per recent reports. It’s a testament to BTC’s “digital gold” status, where entities lock up supply to hedge inflation and chase yields.

A Mosaic of Holders: Public Powerhouses Dominate

Public companies anchor the surge, boasting 203 entities—up from early-year tallies—as firms like MicroStrategy (now Strategy) amass over 640,000 BTC worth $64 billion. Private companies (66) add entrepreneurial flair, often via mining ops like MARA Holdings, which stacked 628,946 BTC at an average $73,288 cost. DeFi/smart contracts (16) bring Web3 innovation, using BTC for liquidity pools and yield farming, while exchanges/custodians (4) and ETFs/funds (4) bridge TradFi. Governments (13), including El Salvador’s ongoing buys, tip the scales toward geopolitical adoption. This breakdown, per BitcoinTreasuries.net, shows BTC’s borderless appeal.

Fresh Blood: 19 Newcomers Stoke the Fire

The past month’s 19 additions span continents and sectors. Japan’s Metaplanet Inc. emerged as a “MicroStrategy clone,” ballooning its treasury to $2.2 billion in BTC. Pension funds like Wisconsin’s Retirement System upped ETF stakes to $321 million, signaling conservative capital’s entry. Mining firms and altcoin diversifiers—hedging with BTC amid $113 billion in public holdings as of September—joined too. These moves, tracked by CoinGecko’s 121 institutions holding 1.5 million BTC (7.22% of supply), tighten liquidity and buoy prices. On-chain data from CryptoQuant shows exchange BTC dipping to six-year lows, as $15 billion shifted to treasuries in weeks.

Rally Fuel or Risky Rally? Uptober’s Double Edge

October’s historical 30% average BTC gains get a turbo-boost here, with $130 billion in treasuries cementing BTC’s hedge narrative amid rate-cut whispers. Yet, as 52% of traders eye shorts (echoing the $11B whale’s $900M bet), rapid onboarding risks a shakeout if volatility spikes. X buzz from @BTC_Archive hails “institutional FOMO,” while skeptics warn of 2021-style dumps. Bottom line: 346 entities holding BTC isn’t just a number—it’s a network effect propelling prices toward $120,000, but only if conviction holds. For crypto natives, it’s validation; for bears, a crowded trade begging for air.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.