Trump vows U.S. dominance in crypto to counter China’s mining surge, eyeing national BTC reserves.

Deregulation Blitz End to SEC crackdowns promised, with GENIUS and CLARITY bills fast-tracked for stablecoin clarity.

America to lead in blockchain-AI synergy, easing dollar pressures amid global tech race.

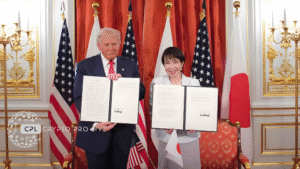

On November 5, 2025, the Kaseya Center in downtown Miami pulsed with electric energy. President Donald J. Trump, fresh off the anniversary of his reelection, took the podium at the star-studded America Business Forum. Flanked by icons like Lionel Messi, Serena Williams, Jeff Bezos, and Nobel Peace Prize winner Maria Corina Machado, Trump’s remarks weren’t just business banter—they were a battle cry for American dominance in the digital age. Amid a backdrop of U.S. flags and booming cheers, the 45th president zeroed in on crypto, framing it as the lifeblood of tomorrow’s economy. With Bitcoin hovering near $85,000 post-speech, the crypto world hung on every word.

Trump didn’t mince words: “We’re making the United States the Bitcoin superpower, the crypto capital of the world, and the undisputed leader in artificial intelligence.” He hailed cryptocurrency as an “industry of the future” that “lifts pressure off the dollar,” positioning it as a strategic asset against global rivals. Drawing a line in the sand, Trump warned of China’s aggressive push into Bitcoin mining and blockchain tech, declaring, “We’re number one in crypto now—that’s what I care about. Don’t want China or anyone to take it away. It’s massive.” This wasn’t rhetoric; it echoed his administration’s pivot toward crypto-friendly policies, including bolstering domestic mining operations and clearer regulatory frameworks. Attendees buzzed as Trump teased executive actions to end the “Gensler-era war on crypto,” signaling an end to stifling SEC overreach.

At the heart of Trump’s address was a deregulation thunderbolt. He slammed bureaucratic hurdles as “job killers” and vowed to unleash American innovation through streamlined rules for stablecoins, DeFi, and NFTs. “Crypto isn’t a side game anymore,” he asserted, urging Congress to pass bills like the GENIUS Act and CLARITY for stablecoin oversight. This comes amid a record-long government shutdown, but Trump framed crypto as a bipartisan winner—easing fiscal strains while supercharging growth. For Miami’s burgeoning “Silicon Beach” scene, home to firms like Blockchain.com, it’s a godsend. The forum’s theme, “The world meets in America,” felt prophetic as Argentine President Javier Milei nodded in agreement, fresh off his own pro-Bitcoin reforms.

Trump’s speech cast crypto as ground zero in the U.S.-China rivalry, with AI as its shadowy twin. “China’s getting very big into Bitcoin,” he cautioned, spotlighting Beijing’s state-backed mining empires and AI integrations. His antidote? A “MAGA 2.0” blueprint: tax incentives for U.S. miners, national Bitcoin reserves, and partnerships with tech titans like Citadel’s Ken Griffin. Analysts see this as a nod to Trump’s sons’ crypto ventures, blending family flair with policy punch. As BTC futures spiked 5% during the live stream, skeptics wondered if hype outpaces delivery—but in Trump’s world, bold claims are the spark for billion-dollar booms.

This Miami moment cements Trump’s evolution from crypto skeptic to evangelist, turbocharging a market already riding election highs. With 138K live views on the White House stream, the ripple (pun intended) is global: expect ETF inflows, altcoin rallies, and a flood of talent to Miami’s shores. Yet, challenges loom—EU’s MiCA clamps down on privacy coins, while U.S. clarity could lure trillions. As Trump wrapped with “America First in everything,” one thing’s clear: crypto’s not just money; it’s the new Manifest Destiny. Buckle up— the blockchain gold rush just got presidential.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.