Trump’s Fed chair hunt signals end of Powell era, promising dovish policies bullish for risk assets like Bitcoin.”

Powell’s reserve addition pledge hints at QE revival, flooding markets with liquidity to fuel crypto rallies.

Crypto traders: Stock up on BTC as political Fed drama meets monetary easing for explosive upside potential.

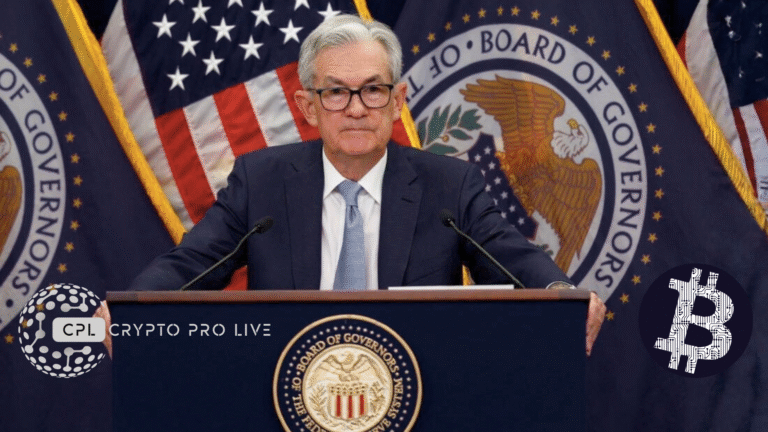

The Powell Purge: Trump’s Fed Fury Ignites Crypto Sparks In a bombshell that sent shockwaves through financial corridors, President Donald Trump has escalated his long-simmering feud with Federal Reserve Chair Jerome Powell, declaring his administration is actively interviewing candidates to replace him “right now.” Speaking on November 18, 2025, Trump didn’t mince words, reiterating his disdain for Powell’s “stubborn” rate policies and hinting at a pre-selected successor to steer the central bank toward his vision of aggressive economic stimulus. For crypto enthusiasts, this isn’t just Washington theater—it’s a prelude to seismic shifts in monetary policy that could supercharge Bitcoin and altcoins, transforming the Fed from foe to fleeting friend.

Trump’s animosity toward Powell dates back to his first term, but with Powell’s chairmanship expiring in early 2026, the gloves are off. The president-elect’s inner circle, including Treasury pick Scott Bessent, has dismissed any interest in the role themselves, leaving the field open for a loyalist who might prioritize growth over inflation hawks. Imagine a Fed head greenlighting unchecked liquidity injections or even flirting with crypto-friendly innovations like a digital dollar overhaul. In crypto’s wild ecosystem, where sentiment swings on a tweet, this political purge spells opportunity. Bitcoin, often hailed as “digital gold,” thrives in low-rate, high-liquidity environments—recall the 2020-2021 bull run fueled by Powell’s pandemic-era printing press.

Yet, the real intrigue unfolds on the Fed’s balance sheet frontier. Just weeks ago, on October 29, Powell himself dropped a tantalizing crumb: “We’ll be adding reserves at a certain point” to accommodate a swelling economy and banking system. This isn’t vague Fed-speak; it’s code for ending quantitative tightening (QT) and pivoting toward expansion, potentially restarting quantitative easing (QE) by early 2026. The Fed’s $6.6 trillion war chest, shrunk via QT since 2022, could balloon anew, flooding banks with cheap money that trickles into speculative assets. For crypto, that’s rocket fuel: Ethereum’s DeFi protocols, Solana’s meme coin frenzy, and Bitcoin’s halving-fueled scarcity narrative all stand to benefit from this deluge.

Liquidity Tsunami: Crypto’s Bullish Bet on Fed Flux

But let’s not pop the champagne yet—volatility lurks. A Trump-anointed Fed chair could amplify policy unpredictability, blending dovish easing with populist tariffs that stoke inflation. Powell’s ouster might accelerate rate cuts, but if the new guard echoes Trump’s “America First” zeal, we could see erratic interventions that spook global markets. Crypto, ever the canary in the monetary coal mine, has already twitched: BTC dipped 2% on Trump’s remarks, only to rebound as traders priced in liquidity tailwinds.

History whispers caution and promise. Post-2008 QE epochs minted crypto’s foundational wealth, with BTC surging from pennies to peaks. Today’s landscape, laced with ETF inflows and institutional adoption, amplifies the stakes. As reserves swell, expect capital rotation from bonds to blockchain—BlackRock’s Bitcoin ETF could see fresh billions, while stablecoins like USDT swell on arbitrage plays.

“Prepare accordingly,” as the whispers go. For the savvy crypto denizen, this Fed fork demands action: HODL core positions in BTC and ETH, eye undervalued alts like Chainlink for oracle booms in a data-hungry easing cycle, and hedge with gold proxies if inflation flares. Trump’s Powell takedown isn’t mere bluster; it’s the spark for a liquidity inferno that could propel crypto to new stratospheres.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.