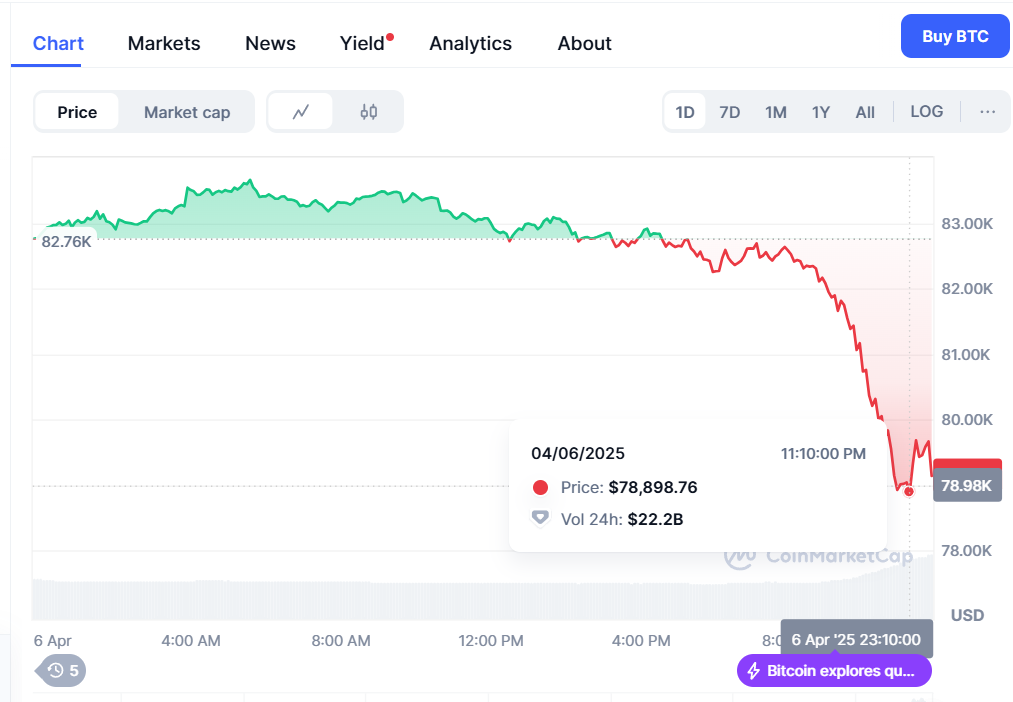

The cryptocurrency market, a realm of high-octane volatility, has once again delivered a rollercoaster of emotions. Bitcoin, the digital king, has been engaged in a fierce battle around the $78,000 mark, a level that’s become a critical battleground for bulls and bears alike. But, as seasoned crypto veterans know, what goes up can also come crashing down, and the recent Sunday crypto dip has left many investors reeling.

The Push to 78K: A Symphony of Factors

Bitcoin’s attempts to solidify its position around $78,000 are fueled by a confluence of factors:

- ETF Euphoria: The continued inflow of capital into spot Bitcoin ETFs in the United States remains a primary driver. These ETFs are opening the doors to institutional investors, injecting massive liquidity into the market.

- Halving Anticipation: The upcoming Bitcoin halving, a programmed event that reduces the rate at which new Bitcoin are created, is generating significant bullish sentiment. Historically, halvings have been followed by substantial price appreciation.

- Macroeconomic Winds: While Bitcoin is increasingly seen as a separate asset class, it’s not entirely immune to macroeconomic trends. Inflation concerns, and potential shifts in monetary policy, also play a role in investor sentiment.

- Market Sentiment: The overall market sentiment has been very bullish, with many investors holding onto the idea that bitcoin will continue to rise. This Fear of missing out, FOMO, is a powerful market driver.

Sunday’s Crypto Quake: When the Market Takes a Breather

However, the crypto market is known for its sudden and often violent corrections. The recent Sunday dip served as a stark reminder of this reality. Several factors can contribute to these sudden price drops:

- Weekend Liquidity: Weekend trading typically sees lower liquidity, which can amplify price swings. With fewer buyers and sellers, even relatively small sell orders can trigger significant price drops.

- Profit-Taking: After periods of sustained gains, traders often engage in profit-taking, selling off their holdings to secure their gains. This can trigger a cascade effect, leading to a broader market sell-off.

- Leveraged Positions: The crypto market is rife with leveraged trading, where traders borrow funds to amplify their gains (and losses). Sudden price drops can trigger mass liquidations of these leveraged positions, exacerbating the downward pressure.

For crypto investors, navigating this turbulent landscape requires a blend of vigilance, strategic foresight, and emotional resilience. Staying informed about market trends, regulatory developments, and technological advancements is paramount. Implementing robust risk management strategies, including setting stop-loss orders and diversifying portfolios, is essential for mitigating potential losses. Maintaining emotional discipline, avoiding impulsive decisions driven by fear or greed, is equally crucial.

The crypto market, while offering the potential for substantial returns, is inherently volatile and demands a long-term perspective. Understanding the cyclical nature of the market, recognizing the impact of external factors, and maintaining a balanced approach are essential for navigating its complexities. The pursuit of knowledge, coupled with a disciplined approach, remains the most potent tool in the arsenal of any crypto investor seeking to thrive in this dynamic and ever-evolving space. The journey is not for the faint of heart, but for those who are willing to learn, adapt, and persevere, the rewards can be substantial.