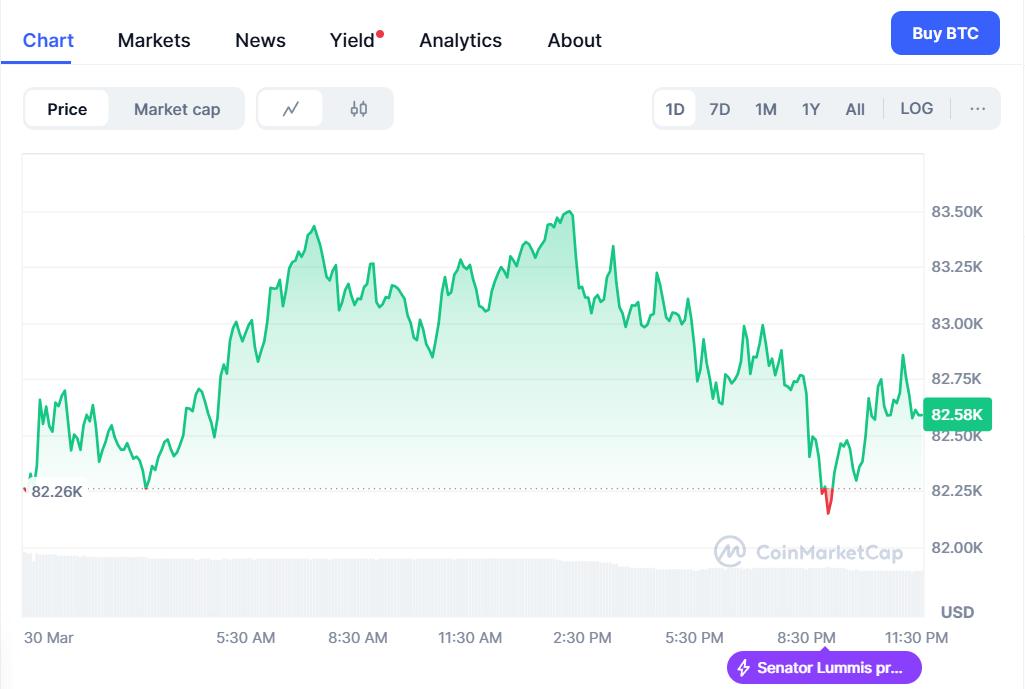

As Bitcoin (BTC) approaches the $82,608 support level, market analysts are closely monitoring its potential impact on select altcoins, including Cardano (ADA), Toncoin (TON), Cronos (CRO), Mantle (MNT), and Render (RNDR). A rebound from this critical threshold could serve as a catalyst for these cryptocurrencies to initiate significant upward movements.

Bitcoin’s Current Landscape

Bitcoin’s recent descent towards the $82,000 mark has garnered attention, with technical indicators suggesting a possible local bottom in this vicinity. Analysts posit that a robust defense of this support level may pave the way for a bullish reversal, potentially propelling BTC towards the $95,000 to $100,000 range. Conversely, a breach below $80,000 could expose the asset to further declines, testing lower support zones.

Cardano (ADA)

Cardano has also been thrust into the spotlight following its inclusion in the U.S. strategic crypto reserve alongside other major cryptocurrencies. This development has resulted in a significant appreciation in ADA’s value, reflecting heightened investor interest. Cardano’s emphasis on security and sustainability, coupled with its methodical development approach, positions it as a strong contender for future growth. Investors are advised to monitor ADA’s performance closely, as it may present lucrative opportunities in the evolving market landscape

Toncoin (TON)

Toncoin has demonstrated resilience by bouncing off its 20-day exponential moving average (EMA) of $3.58, indicating sustained buying interest. The prevailing uptrend, coupled with a relative strength index (RSI) in positive territory, suggests that bulls may attempt to drive the price above the $4.14 resistance. A successful breakout could set the stage for rallies towards $5.00 and subsequently $5.65. However, failure to surpass this barrier may result in consolidation or a retest of support levels around $3.30.

Cronos (CRO)

Cronos has exhibited bullish tendencies by breaking above its moving averages, signaling a potential trend reversal. The asset faces selling pressure near the $0.12 mark, yet the formation of higher lows suggests accumulating strength among buyers. An ascent past the $0.12 resistance could trigger a move towards $0.14. Conversely, a decline below the $0.10 support may invalidate this outlook, potentially leading to a retest of lower support levels.

Mantle (MNT)

Mantle’s price action indicates a consolidation phase, with the asset trading within a defined range. A decisive move above the upper boundary could signal the initiation of an uptrend, targeting higher resistance levels. Traders should monitor volume and momentum indicators for confirmation of a breakout, while remaining cautious of potential downside risks if the asset fails to maintain support levels.

Render (RNDR)

Render has experienced a pronounced downtrend over recent weeks. However, the bulls’ push above the 50-day simple moving average (SMA) of $3.77 on March 25 suggests renewed demand at lower price points. The bears have since pulled the price back to the 20-day EMA at $3.57, a critical level to observe. A strong rebound from this point could propel RNDR towards $5.00 and later $6.20. Conversely, a drop below the 20-day EMA may indicate continued bearish momentum, necessitating caution among traders.

The cryptocurrency market remains at a pivotal juncture, with Bitcoin’s performance around the $80,000 support level serving as a bellwether for broader market sentiment. Altcoins such as TON, CRO, MNT, and RNDR are poised for potential rallies, contingent upon Bitcoin’s stabilization and broader market dynamics. Investors should conduct thorough analyses and remain vigilant, as the volatile nature of the crypto market necessitates informed and strategic decision-making.