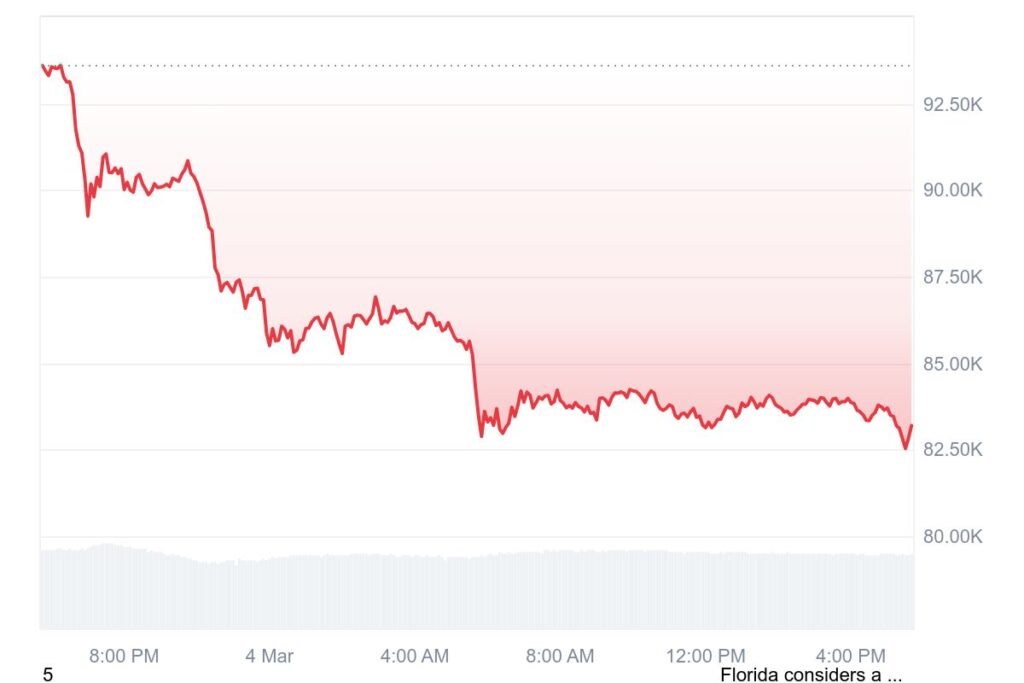

The cryptocurrency market has taken a significant hit recently, largely driven by Bitcoin’s Bearish Shakeout. Over the past 24 hours, Bitcoin (BTC) has lost 8.8% of its value, leading the charge in a broader market downturn. This decline has caused the overall crypto market to drop by 14.7%, bringing its total value down to $2.64 trillion.

Escalating Trade Tensions Fuel Market Uncertainty

The recent imposition of U.S. tariffs on Mexico, China, and Canada, effective March 4, has intensified global trade tensions. In retaliation, Beijing has implemented tariffs of up to 15% on U.S. exports, while Ottawa has imposed 25% tariffs on $107 billion worth of U.S. goods. This escalating trade war has heightened market uncertainty, prompting crypto traders to liquidate positions and secure profits.

Correlation with Traditional Financial Markets

The cryptocurrency market’s decline mirrors downturns in traditional financial markets. On March 3, the S&P 500 fell by 1.76%, the Nasdaq Composite Index declined by 2.64%, and the Dow Jones Industrial Average recorded its second consecutive daily loss, dropping 1.48%. Analysts highlight a strong correlation between Bitcoin and U.S. tech stocks, suggesting that Bitcoin’s long-term recovery may depend on the Nasdaq 100’s performance.

Impact of Liquidations on Market Dynamics

The market downturn has been exacerbated by substantial liquidations, totaling nearly $980 million in the past 24 hours. Long positions were particularly affected, with $831.96 million liquidated. Bitcoin and Ethereum (ETH) experienced the most significant liquidations, amounting to $370.52 million and $193.73 million, respectively. The forced selling associated with these liquidations has increased market supply, applying additional downward pressure on prices.

Technical Analysis: Resistance at Key Moving Averages

From a technical standpoint, the crypto market’s recent decline aligns with a correction trend initiated after encountering resistance at key distribution areas. Specifically, the market has struggled to break above its 200-period exponential moving average (EMA) on the four-hour chart since the February 3 crash. The latest attempt to reclaim this level as support on February 21 failed, resulting in a subsequent decline exceeding 20%.

Investor Sentiment and Market Outlook

The convergence of geopolitical tensions, traditional market volatility, and technical resistance levels has contributed to a risk-averse sentiment among investors. As market participants navigate this complex landscape, the interplay between macroeconomic factors and technical indicators will likely continue to influence cryptocurrency valuations. Investors are advised to monitor developments in global trade policies and traditional financial markets, as these elements are poised to impact the crypto market’s trajectory in the near term.

In conclusion, the cryptocurrency market’s recent downturn underscores its susceptibility to external economic and geopolitical factors. A comprehensive understanding of these influences is essential for investors seeking to navigate the volatile crypto landscape effectively.