JPMorgan’s chart reveals Bitcoin’s undervaluation, hinting at a breakout to $165,000 by 2025.

Wall Street’s Bet: Rising ETF inflows and gold comparison fuel JPMorgan’s bold price prediction.

Saylor’s HODL Anthem: Michael Saylor’s Bitcoin T-shirt meme ignites retail investor enthusiasm.

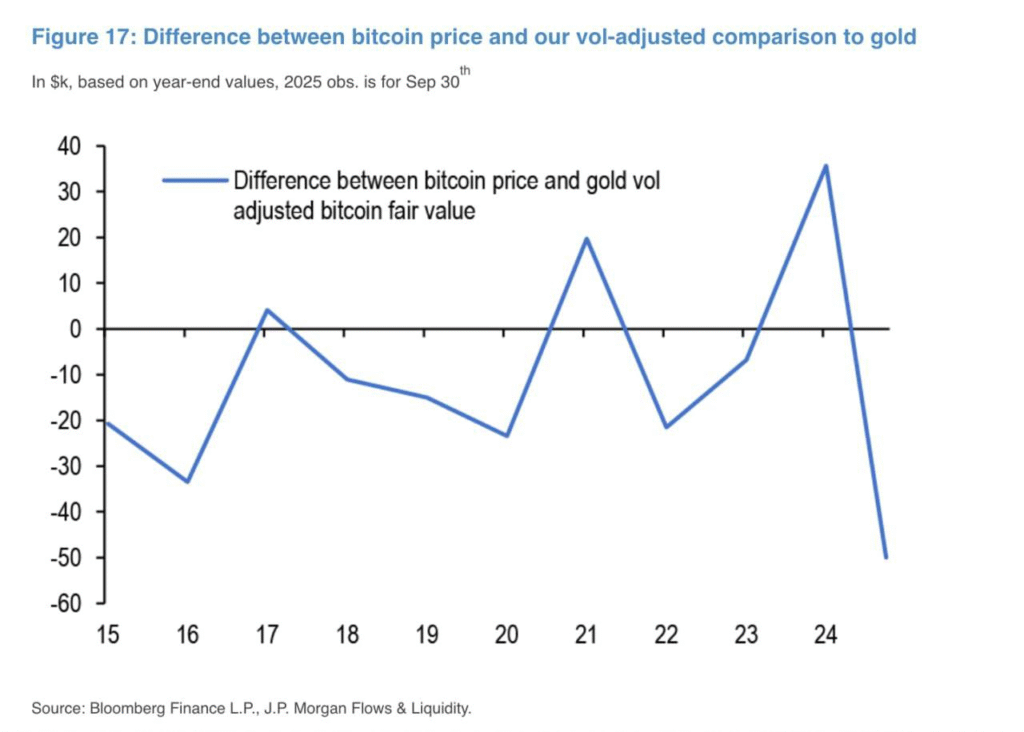

Bitcoin’s ascent is gaining momentum, and a new analysis from JPMorgan analysts has crypto enthusiasts buzzing. A striking chart from Bloomberg Finance, shared via JPMorgan’s latest report, highlights the difference between Bitcoin’s price and its “fair value” adjusted against gold (Figure 17). The graph shows a widening gap, with Bitcoin’s undervaluation peaking in late 2024 before a sharp upward trajectory into 2025. This divergence signals a potential breakout, driven by rising ETF inflows and institutional interest. As of October 4, the chart underscores Bitcoin’s resilience, trading at levels that suggest it’s primed for a historic rally.

JPMorgan’s Bold $165,000 Call

In a report that’s sending shockwaves through the market, JPMorgan analysts predict Bitcoin could hit $165,000 by year-end 2025. The bullish forecast hinges on Bitcoin’s undervaluation compared to gold, a traditional safe-haven asset, coupled with surging ETF investments. With Wall Street giants like BlackRock and Fidelity deepening their crypto exposure, the influx of capital is undeniable. “Bitcoin’s narrative as digital gold is gaining traction, and current prices don’t reflect its true potential,” a JPMorgan spokesperson noted. This projection marks a 150% jump from its current value, fueling optimism amid a volatile market.

Saylor’s Crypto War Cry

Adding fuel to the fire, Michael Saylor—Bitcoin’s most vocal evangelist—recently quipped, “I hope you kept the Bitcoin.” The statement, paired with a striking image of Saylor sporting a glowing Bitcoin T-shirt, reflects his unwavering confidence. Saylor’s company holds over 252,000 BTC, a bet that’s paid off handsomely as Bitcoin’s price climbs. His laser-eyed meme persona has become a rallying cry for HODLers, reinforcing the sentiment that now is the time to hold tight. With corporate adoption on the rise, Saylor’s influence could sway retail investors into the fray.

The Bigger Picture: Risks and Rewards

This bullish outlook isn’t without risks. Regulatory uncertainties and market volatility could derail the rally, especially if global economic conditions tighten. However, the convergence of institutional money, Samsung’s recent Coinbase integration for 75 million users, and Bitcoin’s halving cycle supports the case for growth. The JPMorgan analysis suggests ETF inflows alone could add billions, echoing trends seen in 2021. For now, the crypto community is abuzz, with traders and analysts debating whether $165,000 is the floor or the ceiling.

As Bitcoin eyes new highs, the market stands at a crossroads. JPMorgan’s data and Saylor’s bravado paint a compelling picture, but only time will tell if this bull run delivers. For investors, the message is clear: stay informed and buckle up.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.