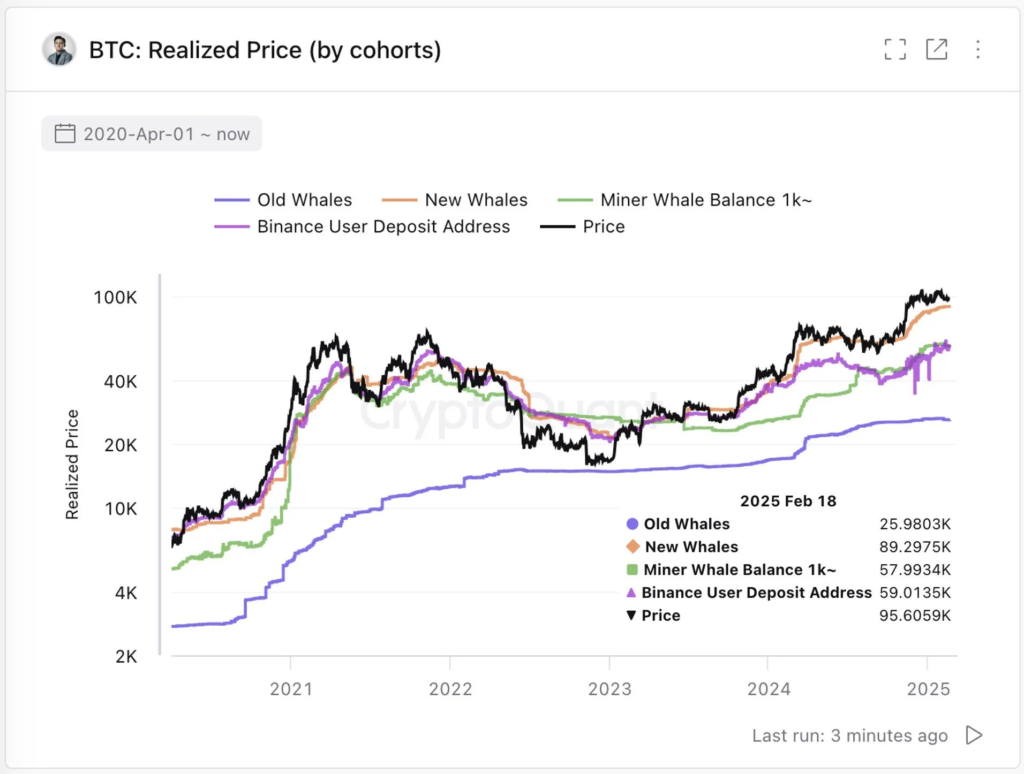

The CEO of CryptoQuant, Ki Young Ju, remains bullish on Bitcoin’s long-term trajectory, asserting that the flagship cryptocurrency will not enter a bear market in 2025—unless its price drops below $57,000. Despite potential volatility, he emphasizes historical on-chain data and institutional accumulation as critical factors sustaining Bitcoin’s bull cycle.

In a recent X (formerly Twitter) thread, Ju highlighted that even if Bitcoin retraces 30% from its all-time high of $110,000 to $77,000, it would not necessarily signal the onset of bearish conditions. Instead, he believes the current market structure mirrors previous bullish cycles, where corrections were a natural part of long-term price expansion.

Bitcoin’s Bull Market Resilient Despite Potential 30% Correction

Historically, the market has only entered a prolonged bearish phase when Bitcoin’s price fell below miners’ cost basis—a pattern observed in May 2022, March 2020, and November 2018. With the current miner support level at $57,000, Ju argues that Bitcoin’s uptrend remains intact unless a deeper breakdown occurs.

“I don’t think we’ll enter a bear market this year. We’re still in a bull cycle. A 30% dip from the all-time high would be in line with previous cycles, not the start of a bear market,” Ju stated.

Institutional Confidence Reinforces Bitcoin’s Strength

Another critical element supporting Bitcoin’s ongoing bull cycle is increased institutional participation. MicroStrategy, now rebranded as Strategy, continues to accumulate Bitcoin with an average cost basis of $65,033. This reflects a growing trend of large-scale investors holding Bitcoin as a strategic asset, further strengthening market resilience.

Compared to 2024, cost bases across major market players have risen, signaling a broader institutional adoption that could cushion against severe downturns. While short-term volatility remains a possibility, on-chain data and institutional accumulation suggest Bitcoin’s long-term trajectory remains bullish.

Market Resilience Despite Corrections

Although Bitcoin may experience price swings, CryptoQuant’s analysis suggests the market remains structurally bullish unless a drastic drop below $57,000 occurs. With institutional investors solidifying their positions and historical cost-basis trends supporting price stability, Bitcoin’s current cycle appears far from over.