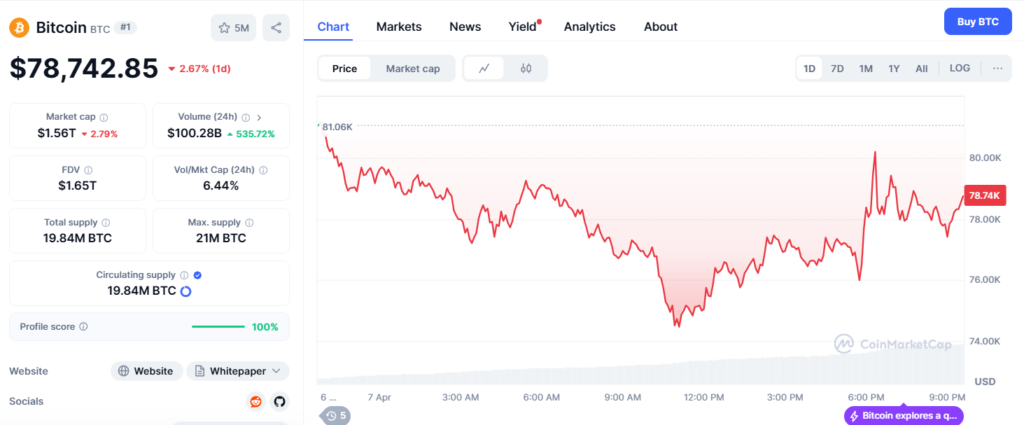

Bitcoin (BTC) continues its rollercoaster ride as the world’s leading cryptocurrency witnessed a sharp one-day dip of $7,060, sliding from $81,060 to $74,000 before rebounding to around $78,742. This significant price action has sent ripples through the crypto markets, leaving investors to question — what’s behind this sudden swing?

Inflation Pressure & Market Reactions

One of the key factors contributing to this recent decline is rising inflation concerns in the U.S. economy. Higher-than-expected inflation data spooked investors, reinforcing expectations that the Federal Reserve may keep interest rates elevated longer than anticipated. Traditionally, this impacts high-risk assets — and Bitcoin is often the first to feel the heat.

Market Sentiment and Speculation

Investor perception plays a pivotal role in Bitcoin’s valuation. Positive news, such as endorsements from influential figures or adoption by major companies, can bolster confidence and drive prices higher. Conversely, negative press, security breaches, or regulatory crackdowns can erode trust, prompting sell-offs and price drops. The speculative nature of the market means that sentiments can shift rapidly, leading to significant volatility.

Regulatory Environment

Government policies and regulations significantly impact Bitcoin’s price. Announcements of stringent regulations or outright bans in major economies can lead to sharp declines. For instance, China’s 2021 crackdown on cryptocurrency transactions led to a notable price drop. Conversely, regulatory clarity and supportive legislation can enhance legitimacy and drive prices upward.

Wikipedia

Macroeconomic Factors

Global economic conditions influence investor behavior regarding Bitcoin. In times of economic uncertainty or inflation, some investors view Bitcoin as a “digital gold,” seeking it as a hedge against traditional market instability. This increased demand can elevate prices. Conversely, during periods of economic stability, investors might favor traditional assets, leading to decreased demand and lower prices.

venturebeat.com

Technological Developments and Security Issues

Advancements in blockchain technology or improvements in Bitcoin’s infrastructure can positively influence prices by enhancing usability and security. However, incidents like hacking of cryptocurrency exchanges or vulnerabilities in the network can undermine confidence, leading to price declines. The decentralized nature of Bitcoin means that security is paramount; breaches can have immediate and profound effects on market perception.

Market Liquidity and Trading Volume

Bitcoin’s market liquidity—how easily it can be bought or sold without affecting its price—also affects volatility. Lower liquidity can lead to more significant price swings, as large trades have a more pronounced impact. Higher trading volumes typically indicate a more liquid market, which can stabilize prices to some extent.

Unforeseen events, such as geopolitical tensions, financial crises, or pandemics, can lead to drastic shifts in investor behavior. For example, during the COVID-19 pandemic, Bitcoin experienced significant price movements as investors reacted to global economic uncertainties.

Bitcoin’s price volatility is the result of a complex interplay of factors, including supply and demand dynamics, market sentiment, regulatory developments, macroeconomic conditions, technological advancements, liquidity, and external events. For investors, staying informed about these elements is essential for making educated decisions in the cryptocurrency market. While the potential for high returns exists, it’s accompanied by substantial risk, underscoring the importance of thorough research and risk management strategies.