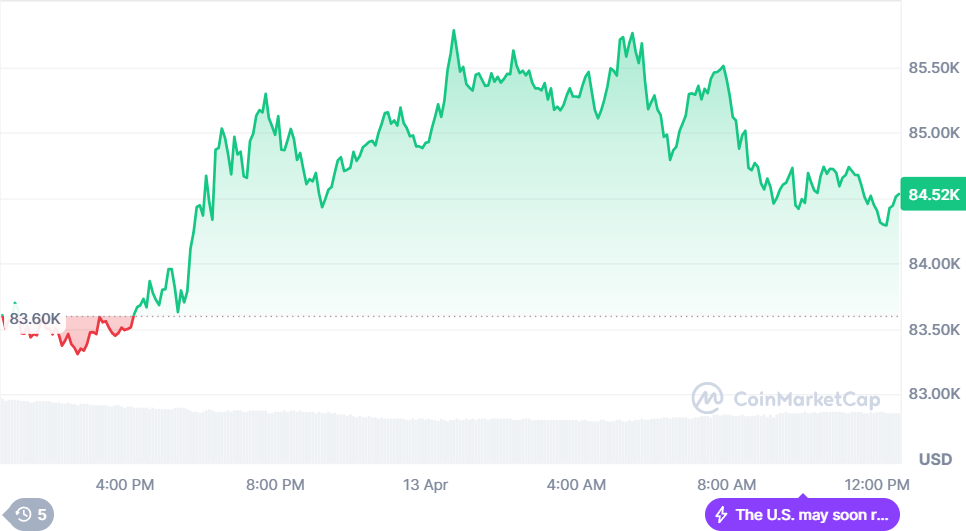

Bitcoin (BTC), the world’s leading cryptocurrency, is once again making headlines. As of April 13, 2025, BTC is trading around $84,537.25 —marking a strong rebound driven by a mix of macroeconomic shifts, growing institutional interest, and public distrust in traditional financial data. What does this mean for crypto investors and the broader market?

Let’s unpack the latest surge, what’s fueling it, and why Bitcoin is gaining trust in a world where fiat currencies are facing credibility issues.

Bitcoin Hits $84,537.25: What’s Behind the Price Action?

After weeks of sideways consolidation, Bitcoin has reclaimed momentum—climbing past $86,000 in the second week of April 2025. A combination of positive macroeconomic developments, geopolitical changes, and strong market sentiment are credited for this breakout.

The key trigger? Easing trade tensions between the U.S. and China. Recent announcements that the U.S. will temporarily lift tariffs on several Chinese technology imports sparked optimism across global markets. This has revitalized investor confidence and nudged institutional capital back into risk-on assets—Bitcoin included.

Economic data also suggests that inflation pressures may be subsiding, opening the door to potential interest rate cuts later this year. These expectations are leading more traders and institutions to rotate capital from bonds and cash into crypto assets like Bitcoin.

Anthony Pompliano Says: “Bitcoiners Saw the Flaws First”

Crypto investor and entrepreneur Anthony “Pomp” Pompliano has doubled down on his stance that Bitcoiners were early to detect flaws in mainstream economic data. He points to questionable metrics used to measure inflation, unemployment, and GDP as reasons why traditional financial models are losing credibility.

“Bitcoiners were the first to say, ‘Hey, something’s broken here,’” said Pompliano in a recent podcast. He argues that long-term holders (HODLers) understood the inevitable devaluation of fiat currencies—especially the U.S. dollar—and positioned themselves in hard assets like BTC.

Over the last 15 years, the purchasing power of the dollar has deteriorated significantly. Bitcoin, by contrast, with its fixed 21 million supply, has proven to be a better store of value.

Institutional Adoption: Bitcoin Becomes a Strategic Asset

One of the biggest drivers of this current rally is continued institutional adoption.

The approval of spot Bitcoin ETFs earlier this year marked a historic milestone. It opened the floodgates for major asset managers, hedge funds, and pension funds to enter the space. BlackRock, Fidelity, and Franklin Templeton have already seen billions flow into their BTC-linked financial products.

Moreover, nations are starting to treat Bitcoin as more than just an investment vehicle. A U.S. Strategic Bitcoin Reserve was recently established—modeled after gold reserves—to help shield the economy against inflation, economic shocks, and foreign debt crises. Countries like El Salvador have paved the way, and others are now exploring similar frameworks.

Bitcoin’s Role as a Hedge in a Flawed Economic System

When economic data is flawed, markets can’t function optimally. If inflation numbers are underreported and job figures overstated, interest rates are mispriced—leading to inefficient capital allocation. This is where Bitcoin shines: it’s transparent, decentralized, and not subject to manipulation by central banks or governments.

In the face of growing concerns over traditional monetary policy, more individuals are seeking refuge in decentralized finance (DeFi) and cryptocurrencies. Bitcoin, with its 15-year track record, is emerging as a digital safe haven.

Could BTC Break $100K Next?

With momentum building and institutional FOMO (fear of missing out) setting in, analysts are now eyeing the psychological $100,000 milestone.

According to MarketWatch, prominent investors like Anthony Scaramucci believe BTC could reach $200,000 within the next 12 months, citing the increasing scarcity of new coins due to halving and the influx of demand from ETFs and sovereign funds.

However, technical analysts are watching key support zones. If Bitcoin maintains strong support above $74,000–$76,000 and breaks resistance at $90,000, the path to six figures could become a reality sooner than expected.

Bitcoin Is More Than a Speculative Asset

The surge in Bitcoin’s price isn’t just driven by hype or retail interest. It’s a reflection of deeper issues in the global financial system—and a growing realization that decentralized assets have a legitimate role in protecting wealth.

With institutional adoption accelerating, fiat currencies weakening, and economic indicators under scrutiny, Bitcoin’s narrative as “digital gold” is gaining credibility like never before.