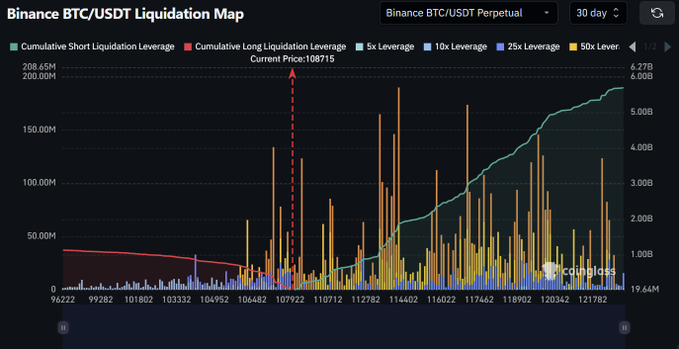

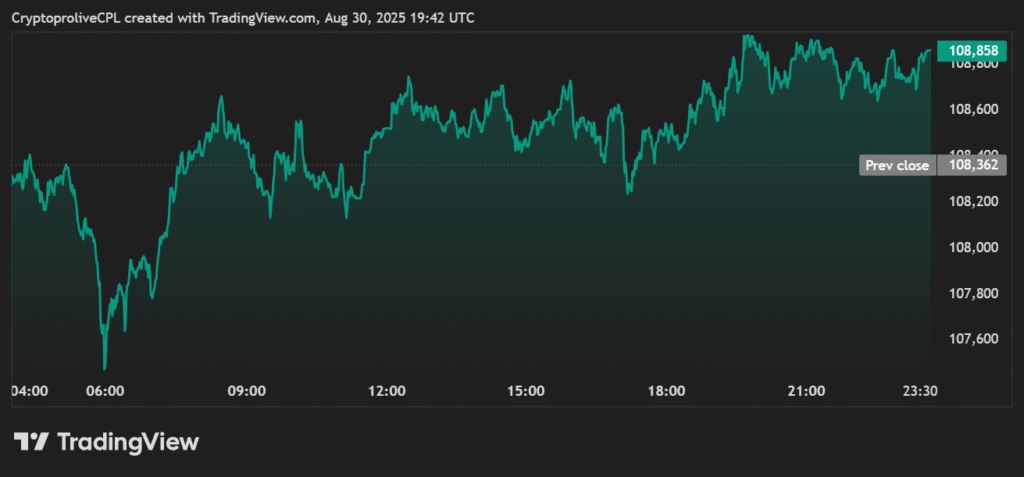

In the volatile world of cryptocurrency trading, few tools reveal the market’s underbelly quite like the Binance BTC/USDT Liquidation Map. As of August 30, 2025, this heatmap paints a precarious picture for leveraged traders, with a staggering $2 billion in short positions teetering on the brink of liquidation if Bitcoin surges to $115,000. Currently trading at around $108,500—down over 3% in the last 24 hours—BTC remains in a precarious consolidation phase after peaking at $124,000 earlier this month. But the map’s signals suggest a potential short squeeze that could ignite a rapid rally, wiping out bearish bets and propelling prices higher.

The liquidation map, a visual representation of cumulative leverage across various levels, highlights clusters where overleveraged positions could cascade into mass forced closures. Green bars dominate the short liquidation side above the current price, indicating heavy bearish positioning with up to 100x leverage in orange and yellow zones. At $115,000, this $2B cluster—built from aggressive shorts placed during recent dips—looms as a “magnet zone.” If BTC breaks upward, these liquidations would trigger buy orders to cover positions, creating a feedback loop of upward momentum. Conversely, the red long liquidation bars below $100,000 signal downside risk if support fails, but the asymmetry favors bulls: shorts outnumber longs by a wide margin in high-leverage areas.

This setup isn’t random. Bitcoin’s recent pullback from its all-time high of $124,290 on August 14 stemmed from profit-taking and macroeconomic jitters, including lingering effects from the Federal Reserve’s rate decisions and geopolitical tensions. Yet, institutional inflows tell a different story. Spot Bitcoin ETFs have amassed over $166 billion in assets, with BlackRock and Fidelity leading the charge. MicroStrategy’s latest $2.46 billion BTC purchase underscores corporate conviction, while analysts like those at VanEck and Bitwise forecast $180,000–$200,000 by year-end, driven by ETF demand and regulatory tailwinds under the Trump administration.

For traders, the map is a risk management bible. Scalpers might eye $115,000 as a breakout target, setting stops below $105,000 to avoid long squeezes. Long-term holders should view this as validation of BTC’s resilience—short liquidations often precede 20–30% pumps, as seen in past cycles. However, volatility reigns: a drop to $103,000 could activate $5.7B in longs at $123,000 levels, though that’s less immediate.

As Bitcoin navigates this leverage minefield, the liquidation map underscores a timeless crypto truth: in a market of extremes, the house always wins on overconfidence. With $2B in shorts primed for explosion, $115,000 could be the spark that reignites the bull run. Stay vigilant—opportunities abound, but so do the pitfalls.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.