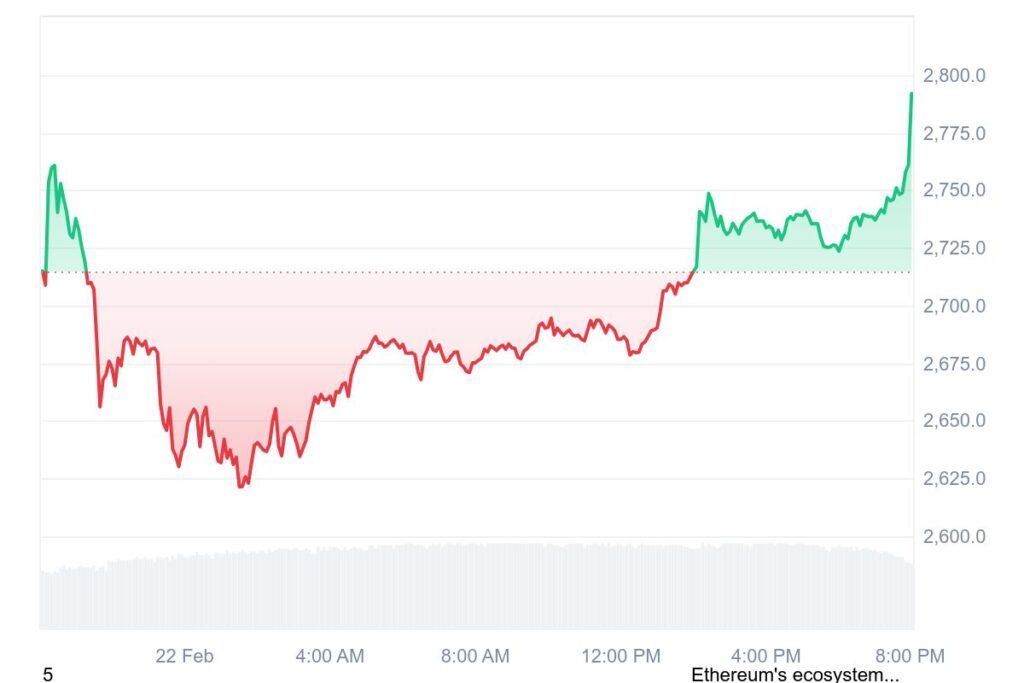

Ethereum (ETH) has taken a hit, with its price dropping to $2,769.67, marking a 1.64% decline. Investors are left wondering—what’s causing this downturn? Let’s break down the key factors influencing Ethereum’s price drop today.

Bybit Security Breach Shakes Investor Confidence

A major security breach at crypto exchange Bybit has sent shockwaves through the market. On February 21, Bybit confirms solvency amidst $1.46 billion security breach, including more than 400,000 ETH. This massive exploit has raised concerns about the safety of digital assets, leading to panic selling and increased volatility in the market. The fear surrounding security breaches often triggers negative sentiment, and Ethereum is feeling the pressure.

Regulatory Crackdown Adds to the Pressure

The crypto space has been facing increased scrutiny from regulators, and Ethereum is no exception. Recent legal actions by the U.S. Department of Justice against high-profile figures in the crypto industry have created uncertainty among investors. With potential new regulations looming, traders are reacting cautiously, causing a slowdown in market activity and contributing to Ethereum’s price drop.

Rising Competition from Rival Blockchains

Ethereum’s dominance is being challenged by competitors like Solana and Tron, which offer faster and more cost-efficient transactions. As more developers and projects migrate to these alternative blockchains, Ethereum’s demand is being impacted. While Ethereum still maintains its stronghold in DeFi and NFTs, the growing competition is making investors rethink its long-term value proposition.

Bearish Technical Indicators Signal Further Decline

From a technical standpoint, Ethereum is showing signs of further bearish momentum. The formation of a “death cross,” where short-term moving averages dip below long-term averages, suggests a prolonged downtrend. Additionally, on-chain data reveals that large holders, including the Ethereum Foundation, have been offloading ETH, increasing selling pressure and driving prices lower.

What’s Next for Ethereum?

Despite the current setback, Ethereum remains one of the most influential blockchain networks. Analysts believe that upcoming network upgrades, including scalability improvements, could help Ethereum regain momentum. However, in the short term, macroeconomic conditions, security concerns, and regulatory developments will continue to play a crucial role in ETH’s price movements.

For now, traders should keep an eye on these key factors and stay updated on market trends before making any investment decisions.

One thought on “Decoding Ethereum’s Price Drop: What Investors Need to Know”