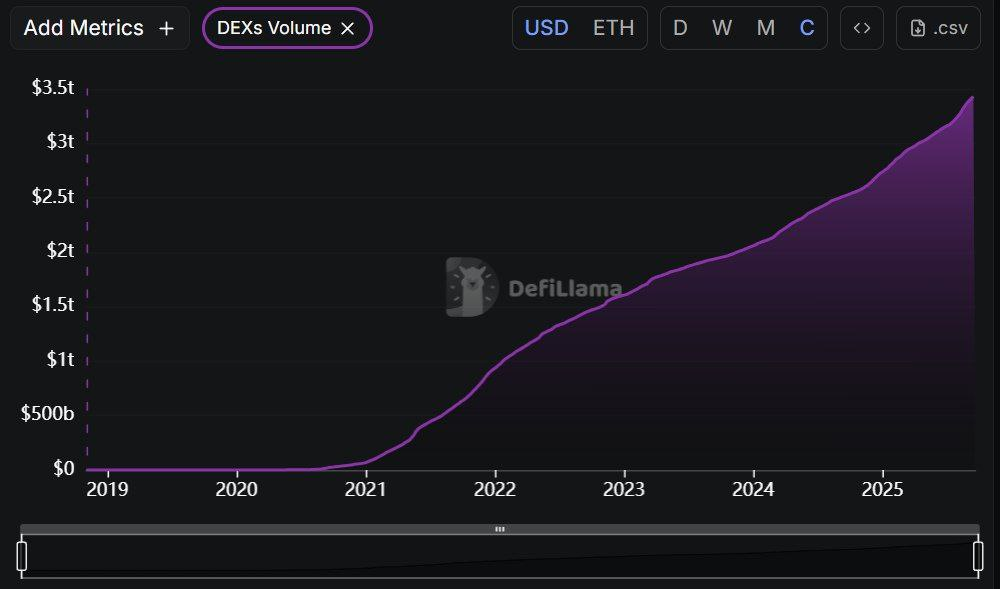

ETH’s cumulative DEX volume reaches $3.5 trillion, marking a DeFi milestone.

Growth accelerated post-2020, crossing $2 trillion by 2023.

The milestone underscores ETH’s dominance amid evolving market dynamic

A Milestone in Decentralized Finance Ethereum (ETH) continues to solidify its position as the backbone of decentralized finance (DeFi), with its cumulative DEX (Decentralized Exchange) volume reaching an astonishing $3.5 trillion. ETH’s enduring dominance in the DeFi ecosystem as of 01:45 AM +04 on Sunday, September 21, 2025. The upward trajectory, spanning from 2019 to 2025, underscores the network’s resilience and adaptability amid evolving market conditions.

The Growth Trajectory Unveiled

The chart, sourced from DeFiLlama, illustrates a steady climb, with significant acceleration post-2020 as DeFi adoption surged. Starting near zero in 2019, the volume crossed $1 trillion by 2021, $2 trillion by 2023, and now stands at $3.5 trillion in 2025. This exponential growth highlights the increasing trust and utility of ETH-based DEXs like Uniswap and SushiSwap, which have become staples for traders and liquidity providers. The recent spike suggests a robust 2025 for DeFi, driven by new protocols and institutional interest.

Implications for ETH and the Market

This $3.5 trillion milestone is more than a number—it’s a testament to ETH’s critical role in the blockchain economy. The volume reflects billions in transactions, reinforcing ETH’s value proposition as the preferred platform for smart contracts and decentralized applications. For investors, this could signal further price appreciation, especially if DeFi activity intensifies. However, it also raises questions about scalability and network congestion, areas where Ethereum’s ongoing upgrades aim to address. As of now, the market watches closely, with this figure likely to influence ETH’s short-term momentum.

Looking Ahead: What’s Next for ETH?

With $3.5 trillion in cumulative DEX volume, ETH is poised for continued relevance, though challenges like competition from layer-2 solutions and rival blockchains loom. The data suggests a maturing DeFi sector, potentially attracting more capital inflows. As 2025 progresses, ETH’s ability to maintain this momentum will depend on innovation and market stability. For now, this milestone cements ETH’s leadership, offering a bullish outlook for the network and its ecosystem.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.