Global trade tensions and economic policies are exerting significant pressure on cryptocurrency markets as of March 2025. The introduction of new tariffs by President Donald Trump has heightened economic uncertainty, leading to increased volatility in both traditional and digital asset markets.

Bitcoin’s Decline Amid Geopolitical Uncertainty

Since the announcement of these tariffs on January 20, 2025, Bitcoin (BTC) has experienced a notable decline, dropping over 17% from its previous highs. This downturn underscores the sensitivity of cryptocurrencies to geopolitical events and macroeconomic policies.

Analysts anticipate that these trade tensions will continue to influence market dynamics until at least April 2, 2025, when reciprocal tariff rates are scheduled to take effect. Nicolai Sondergaard, a research analyst at Nansen, suggests that the resolution of these tariff issues could serve as a significant market catalyst, potentially restoring investor confidence and stabilizing asset prices.

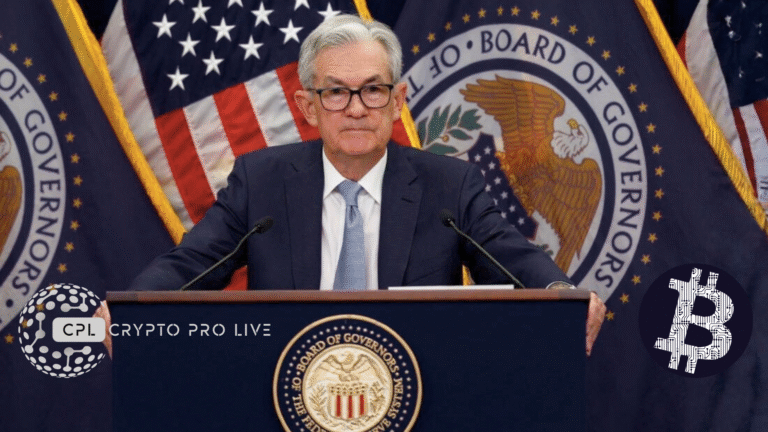

In addition to trade policies, monetary policy decisions are also impacting investor sentiment. The Federal Reserve’s stance on interest rates plays a crucial role in shaping risk appetite. Markets are currently pricing in an 85% chance that the Fed will maintain current interest rates during the upcoming Federal Open Market Committee meeting on May 7, 2025. High interest rates tend to suppress risk appetite among investors, affecting both traditional and digital asset markets.

Despite these challenges, there are optimistic projections within the cryptocurrency community. Some analysts predict a robust Bitcoin comeback in April 2025, with expectations of new all-time highs. Additionally, forecasts suggest that Bitcoin could reach targets between $150,000 and $180,000 in 2025, especially if the Federal Reserve moves toward interest rate cuts amid economic slowdown signals.

President Trump’s Crypto Strategy and Regulatory Plans

Moreover, President Trump’s administration has expressed a strong commitment to transforming the United States into a leading hub for Bitcoin and cryptocurrencies. In a recent address to the Blockworks Digital Assets Summit, President Trump announced plans to introduce clear regulations for stablecoins and market structures, aiming to stimulate investment and innovation in the crypto sector. He emphasized the potential economic growth and strengthening of the U.S. dollar through dollar-backed stablecoins, predicting an era of financial development centered in the U.S.

In summary, while current trade tensions and economic policies are creating headwinds for cryptocurrency markets, the potential resolution of these issues, coupled with supportive regulatory developments, could pave the way for a bullish phase in the near future. Investors are advised to stay informed about geopolitical events and policy decisions, as these factors are likely to continue influencing market dynamics in the coming months.