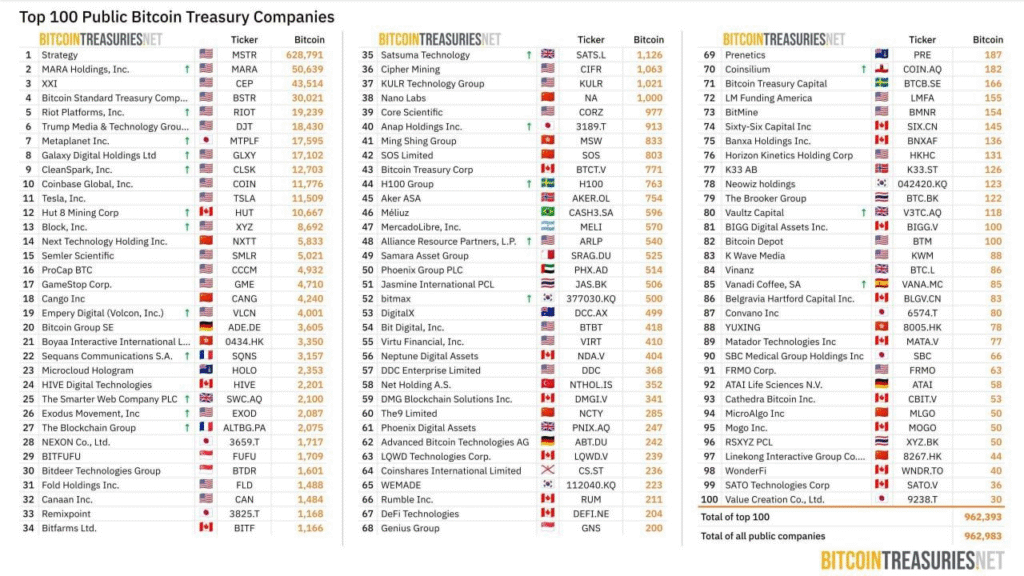

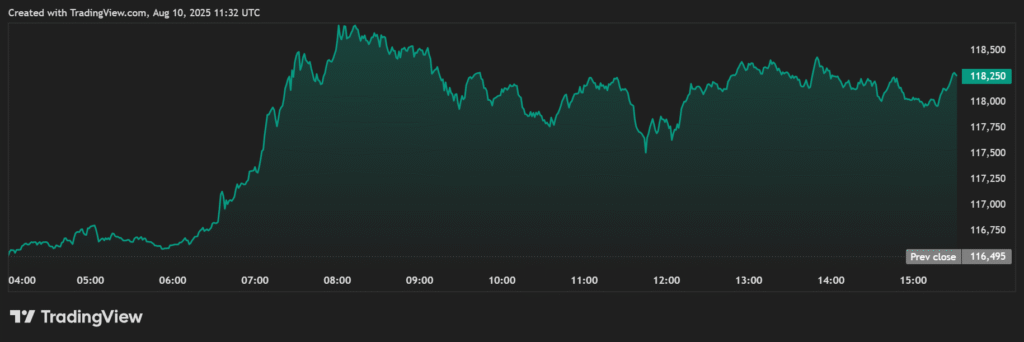

Nearly 1 million Bitcoin—valued at over $110 billion—are now sitting in the treasuries of the world’s top 100 public companies, marking one of the strongest institutional endorsements the cryptocurrency market has ever seen. According to the latest data from BitcoinTreasuries.net, these corporations collectively hold approximately 962,542 BTC, putting them just shy of the symbolic 1 million BTC milestone. At current market prices, with Bitcoin trading between $114,000 and $119,000, that stash is worth between $110 billion and $118 billion, cementing Bitcoin’s role as a serious reserve asset in the corporate world.

The leader of this pack is none other than MicroStrategy, now rebranded as Strategy, which holds a staggering 628,791 BTC—more than 65% of the total Bitcoin in corporate treasuries. This holding, valued at over $72 billion, has transformed Strategy into the ultimate Bitcoin proxy stock. The company has strategically issued both equity and debt to fund its BTC purchases, a move that has paid off handsomely as its stock price has surged over 3,000% in the past five years. Other notable corporate holders include Marathon Digital Holdings, Riot Platforms, Twenty One Capital, Trump Media & Technology Group, Metaplanet, Galaxy Digital, and CleanSpark, each securing tens of thousands of BTC as part of their treasury strategies.

For these companies, Bitcoin serves as more than just a speculative asset—it is increasingly seen as a hedge against inflation, a store of value, and a long-term growth bet. In a global economy grappling with persistent inflation, low bond yields, and fiat currency devaluation, corporate Bitcoin accumulation is becoming a strategic treasury management tool. Public companies with large Bitcoin reserves offer traditional investors indirect exposure to the cryptocurrency without requiring them to purchase and custody BTC directly. This “Bitcoin proxy” effect has fueled significant investor interest, particularly in firms whose core operations are outside crypto mining or trading but still maintain substantial BTC reserves.

Institutional accumulation of Bitcoin is also a clear signal of market confidence. In 2024 and 2025, favorable regulatory developments in the United States and several other jurisdictions have emboldened corporate adoption. These tailwinds, coupled with growing mainstream acceptance, have led to a surge in corporate Bitcoin purchases. CoinGecko reports that public companies’ combined Bitcoin holdings have risen by more than 150% year-over-year, with aggregate valuations jumping above $103 billion even before the latest price rally. The narrative is clear: Bitcoin is no longer just an alternative asset for tech-forward visionaries—it is now a legitimate treasury reserve option for a growing number of institutions.

However, corporate Bitcoin accumulation is not without risk. The most obvious challenge is volatility. While Bitcoin’s long-term trajectory has been upward, short-term price swings can be extreme. A significant price correction could wipe billions from a company’s balance sheet in a matter of days. This is particularly dangerous for firms that have leveraged their Bitcoin purchases through debt, as falling prices could trigger liquidity crunches or even force sales at a loss. There is also the concern that companies are effectively transforming themselves into Bitcoin ETFs without the regulatory oversight or investor safeguards typical of such investment vehicles. Critics warn that the current wave of corporate Bitcoin buying has echoes of past speculative bubbles, where companies pivoted to hot sectors—like dot-coms in the late 1990s—without a clear operational rationale.

Transparency is another sticking point. While blockchain technology allows for public verification of Bitcoin transactions, many corporations do not disclose wallet addresses or provide on-chain proof of their holdings. This lack of verifiable transparency can raise concerns among investors and analysts. Furthermore, regulatory ambiguity remains a challenge. The accounting treatment of Bitcoin holdings continues to evolve, with some jurisdictions classifying them as intangible assets, which can distort financial statements and complicate valuation metrics.

Despite these risks, the corporate Bitcoin treasury trend shows no sign of slowing. Analysts predict that the top 100 companies could surpass the one-million-BTC mark within the next 12 months if accumulation continues at the current pace. With Bitcoin’s fixed supply of 21 million coins, large institutional holdings have the potential to reduce available market supply, adding upward pressure on prices. This dynamic could further reinforce the “store of value” narrative and attract even more corporate players into the space.

The implications for investors are significant. For those bullish on Bitcoin but hesitant to hold it directly, shares in Bitcoin-heavy companies offer an alternative investment vehicle—albeit with operational and management risks layered on top of the crypto exposure. For companies, holding Bitcoin can be a double-edged sword: it offers the potential for outsized gains in a bull market but can also amplify financial stress during downturns. Savvy corporate treasurers may seek to balance Bitcoin holdings with active risk management, possibly using derivatives or yield-generating strategies to offset volatility.

Looking ahead, the growing presence of Bitcoin in corporate treasuries is likely to shape both market sentiment and regulatory agendas. As more large-cap firms add BTC to their balance sheets, pressure may mount on accounting standards boards, financial regulators, and institutional custodians to provide clearer frameworks for valuation, reporting, and risk disclosure. At the same time, the adoption curve may accelerate as early adopters demonstrate strong performance relative to peers, fueling a competitive “fear of missing out” among corporate CFOs.

In the grand scheme, the fact that the top 100 public companies now hold nearly 1 million Bitcoin underscores just how far the asset has come since its inception in 2009. Once dismissed as a niche experiment in digital money, Bitcoin has evolved into a globally recognized financial instrument held by some of the most influential companies in the world. Whether this trend proves to be a sustainable strategy or a speculative excess remains to be seen—but one thing is certain: corporate Bitcoin accumulation has become a defining feature of the cryptocurrency era.