The cryptocurrency market is a perpetual dance between technical patterns and fundamental strengths, and Solana ($SOL) finds itself at a pivotal juncture in mid-2025. Recent analyses have pointed to the potential for a price re-test of the crucial $120 mark, driven by bearish technical formations. However, beneath the surface of price charts, robust on-chain data presents a compelling “silver lining,” suggesting that Solana’s long-term trajectory remains firmly pointed upwards, providing a nuanced perspective for astute crypto investors and readers.

The Technical Bear: A Head-and-Shoulders Threat

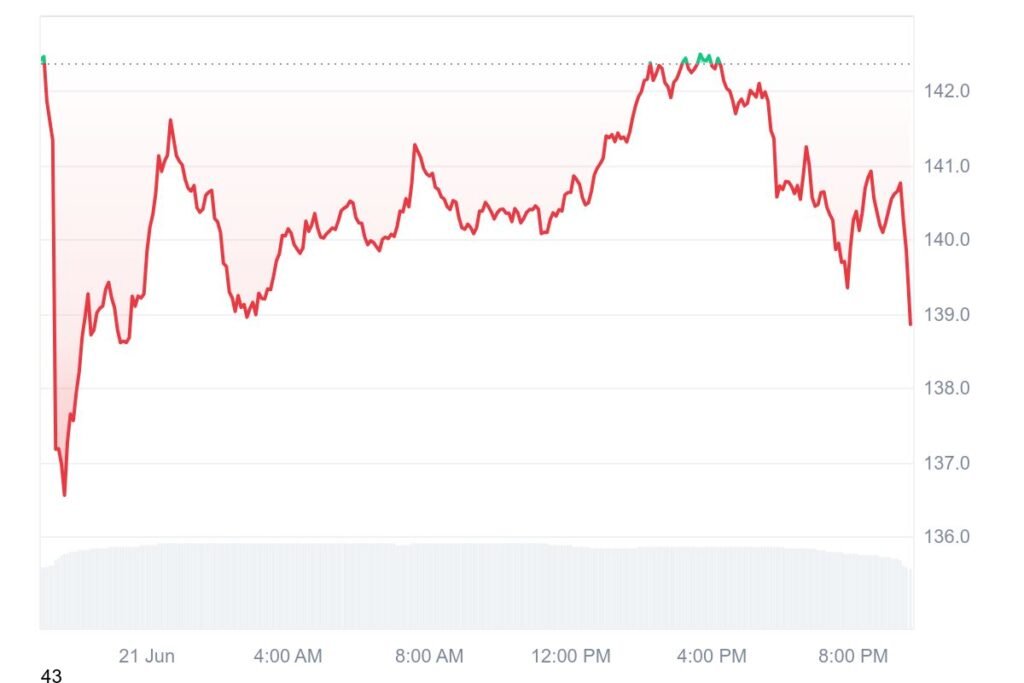

For many traders, the daily chart of SOL has painted a cautious picture. A prominent head-and-shoulders pattern, a widely recognized bearish reversal signal, has been a key concern. This pattern, characterized by three peaks with the middle one (the “head”) being the highest, followed by a neckline, often signals a potential downward trend if the price breaks below that neckline.

Specifically, a breakdown below the $140 neckline level, especially if accompanied by a significant volume spike, could indeed trigger a bearish continuation. Technical projections from such a pattern often target a decline towards the $126 region, a level that aligns with an immediate liquidity zone for SOL. Increased sell-side pressure, potentially influenced by broader market movements and Bitcoin’s ($BTC) own volatility, could certainly exacerbate this corrective trend for Solana in the short term.

The On-Chain Silver Lining: Beneath the Price Action

Despite the warnings from technical analysis, the underlying health of the Solana network, as revealed by on-chain metrics, offers a powerful counter-narrative. This “silver lining” indicates that beneath short-term price fluctuations, Solana’s fundamentals are remarkably resilient and point towards a bullish future.

- Network Value to Transactions Ratio (NVT) at Multi-Month Lows: The NVT ratio, often compared to a Price-to-Earnings (P/E) ratio for traditional stocks, measures the value of a blockchain network relative to the volume of transactions it processes. A low NVT suggests that the network’s usage and activity are robust compared to its current market valuation. Solana’s NVT has reportedly dropped to its lowest score since February 2025, signaling that the network is being heavily utilized without its market cap inflating disproportionately. This indicates genuine utility and strong organic demand, rather than mere speculative hype.

- Consistent SOL Withdrawals from Exchanges: Analysis of the Exchange Net Position Change chart reveals a consistent trend of SOL being withdrawn from centralized exchanges. This behavior is a strong indicator of investor confidence and accumulation. When investors move their assets off exchanges to personal wallets or cold storage, it typically suggests an intent to hold for the long term, rather than preparing to sell. This ongoing accumulation reduces the immediate sell pressure on exchanges and points towards a belief in future price appreciation.

Recent Updates and Broader Solana Ecosystem Trends (Mid-2025 Context):

Beyond the specific metrics, several broader trends are shaping Solana’s narrative in mid-2025:

- Developer Activity and Ecosystem Growth: Solana continues to attract a vibrant developer community, consistently ranking among the top blockchains for developer engagement. This ongoing innovation fuels the launch of new DApps, DeFi protocols, and NFT projects, driving further utility and network activity. The growth of its decentralized physical infrastructure networks (DePIN) sector is particularly noteworthy.

- Scalability and Performance: Solana’s core value proposition of high throughput and low transaction costs remains a critical differentiator. As the crypto ecosystem expands and user demand grows, Solana’s ability to handle massive transaction volumes without significant network congestion continues to make it an attractive platform for developers and users alike. Ongoing efforts to enhance network stability and address past outages are crucial for maintaining confidence.

- Competition and Interoperability: While facing stiff competition from other Layer-1 blockchains, Solana is also increasingly exploring interoperability solutions. Bridging to other ecosystems and enhancing cross-chain capabilities could expand its reach and attract more capital and users.

- Institutional Interest: Beyond retail, institutional interest in Solana is steadily growing. As regulatory clarity (e.g., around potential staked ETFs for ETH and SOL) evolves, more traditional financial players are exploring ways to gain exposure to high-performance blockchains like Solana, drawn by its speed and burgeoning ecosystem. The recent debates around staked ETFs, though facing SEC hurdles for specific structures, highlight the desire for regulated access to Solana’s yield potential.

- Broader Market Sentiment: Solana’s price movements are, of course, influenced by the overall crypto market sentiment, particularly Bitcoin’s performance. A strong Bitcoin run often pulls altcoins higher, while a correction can lead to broader market downturns. Investors are closely watching global macroeconomic conditions and regulatory developments as they impact the entire crypto space.

Investor Outlook Balancing Short-Term Caution with Long-Term Optimism

For crypto investors eyeing Solana, the current landscape presents a dichotomy. The technical indicators suggest a potential short-term correction, emphasizing the need for cautious risk management. Traders might consider setting stop-losses or waiting for clearer bullish confirmations before re-entering aggressively.

However, the “silver lining” on-chain data paints a very compelling picture for Solana’s long-term fundamentals. The high network utility relative to its valuation, coupled with consistent accumulation by investors, points to a strong underlying demand and belief in its future. This suggests that any short-term dips might be viewed as accumulation opportunities by those with a long-term vision.

Solana’s Resilient Path Ahead

Solana stands at a fascinating crossroads in mid-2025. While immediate price action may be dictated by bearish technical patterns and broader market sentiment, the robust on-chain activity and sustained developer interest underscore its fundamental strength. For crypto investors, understanding this duality is key. Short-term volatility is an inherent characteristic of the market, but Solana’s growing utility, active ecosystem, and increasing investor confidence provide a solid foundation for continued relevance and potential growth in the evolving digital asset landscape. The journey to mass adoption is complex, but Solana’s resilience offers a beacon of optimism.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.