China’s Escalatory Edge: Beijing’s resource curbs and retaliation tactics force US backdowns, tilting global trade in its favor.

Expect BTC swings as tariffs fuel de-dollarization; historical patterns show significant rallies post-escalation.

Blockchain as Trade Weapon Digital currency pilots could bypass traditional systems, boosting adoption for borderless settlements.

A recent analysis reveals China is “winning the trade war” and “breathing more easily than America.” Forget the bravado from Washington calling China “weak”—Beijing has rebuffed coercion, rewritten global commerce norms, and turned America’s own tactics against it. As tariffs climb and tech bans bite, the regime isn’t flinching. Instead, it’s flexing “escalatory dominance,” from resource export curbs to savvy retaliation that leaves the US blinking first.

This isn’t speculation. Seven years into the conflict, China has pinpointed US vulnerabilities—supply chain chokepoints, tech dependencies—and mitigated its own with ruthless efficiency. Remember the recent tariff hike? It crumbled under economic pressure. Threats of high duties on key resources? Backpedaled amid mutual pain. The playbook: Absorb hits, strike surgically, and lure allies into its orbit. The result? A reshaped trade landscape where America’s isolationist tactics erode trust, while China leads the charge.

Crypto’s High-Stakes Pivot: From Tariff Turbulence to Blockchain Lifeline

For crypto traders, this drama is a volatility vortex. Trade wars have always been Bitcoin’s frenemy: Short-term fear sparks sell-offs, but long-term fractures fuel adoption. As tensions spike, expect BTC to fluctuate. Precious metals are already up on safe-haven bids; BTC, the “digital gold,” could follow if de-dollarization accelerates.

China’s edge? It’s weaponizing trade to hoard crypto-relevant assets. Key resources power semiconductors for mining rigs and advanced chips—vital to blockchain scalability. Export squeezes could raise hardware costs, favoring state-backed operations. Yet, a deeper strategy emerges: a digital currency integration with trade partners signals blockchain as a trade-war advantage. If this rolls out, it bypasses traditional financial systems, making the US dollar less relevant for a significant portion of global GDP.

Bitcoin’s Battle Cry: Hedge Against Empire’s End?

Enter the bull case for crypto enthusiasts. Experts warn trade wars breed inequality and erode dominance. As America doubles down on coercion, capital flees to decentralized havens. We’ve seen it before: past tariff escalations sent BTC soaring as investors bet on borderless money. Today, with new tariff threats, data shows large investors accumulating—50K BTC scooped up recently alone.

Subheadings shine: Decentralized finance could explode as collateral for cross-border swaps, dodging tariff nets. Digital assets? Tie them to resource provenance for transparent supply chains. But risks loom—regulatory crackdowns if crypto is seen as a tool of adversaries. Still, history favors the disruptors. China’s “breathing easy” means it’s innovating quietly; America’s gasping? That’s your cue to invest in digital assets.

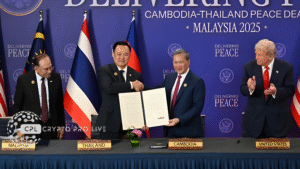

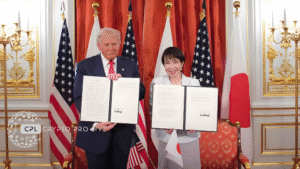

In this zero-sum game, crypto isn’t collateral—it’s the escape hatch. As leaders stare down challenges at the upcoming summit, markets will misprice the chaos. Position now: Invest in BTC, hedge with stablecoins, and watch for digital currency pilots. The trade war’s real winner? The network that trades without borders.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.