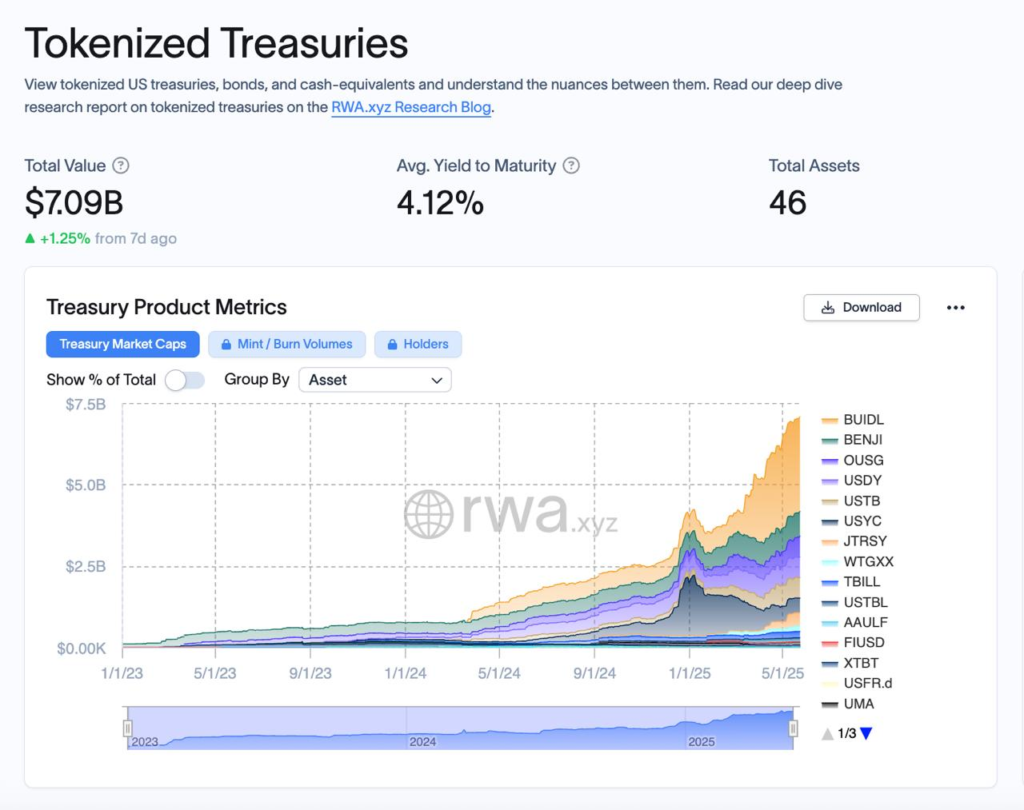

In a major milestone for blockchain adoption in traditional finance, tokenized U.S. Treasuries have officially surpassed $7 billion in total value, marking a significant shift toward institutional engagement with on-chain financial instruments. At the forefront of this movement is BlackRock’s BUIDL fund, which is now nearing $3 billion in assets under management. This trend not only reflects growing confidence in blockchain infrastructure but also highlights a maturing investment strategy among large financial institutions.

BlackRock’s BUIDL Leads the Tokenization Revolution

The BUIDL fund, launched by asset management giant BlackRock, has quickly emerged as a dominant player in the tokenized treasury landscape. Built on the Ethereum-based blockchain ecosystem, BUIDL enables seamless, 24/7 access to tokenized U.S. government securities—bringing together the reliability of traditional instruments with the speed and transparency of decentralized finance (DeFi).

According to data from crypto analytics platforms, the tokenized treasury market has seen $54 million in new inflows over the past week alone. Much of this growth can be attributed to institutional investors seeking yield-bearing assets in a blockchain-native format. These instruments are programmable, auditable, and accessible across borders, giving them a distinct edge over legacy systems.

Institutional Appetite for On-Chain Assets Is Growing

The surge in tokenized Treasuries signals a broader trend: institutional players are embracing blockchain technology. From hedge funds and private equity to sovereign wealth funds, traditional finance (TradFi) is increasingly recognizing the value of tokenizing real-world assets (RWAs). These include not just government bonds, but also real estate, commodities, and even intellectual property.

“Tokenization is not a buzzword anymore—it’s a business model,” said a senior analyst at Messari. “When a company like BlackRock commits billions to an on-chain strategy, it’s a green light for the rest of the financial world.”

Bitcoin Price Holds Above $108K: Market Signals Strong Bullish Sentiment

Meanwhile, Bitcoin (BTC) continues its impressive rally, currently trading at $108,152, after reaching a new all-time high of $110,524 earlier this week. The flagship cryptocurrency has been buoyed by renewed optimism in macroeconomic stability, U.S. regulatory clarity, and increasing institutional inflows.

Notably, the rally comes in tandem with rising speculation around a Strategic Bitcoin Reserve, a concept reportedly under consideration by several nation-states. The idea, made mainstream by former President Donald Trump’s pro-crypto policy stances, has added a layer of geopolitical intrigue to Bitcoin’s price action.

As Bitcoin’s scarcity model aligns with global inflationary pressures, investors are increasingly viewing it as “digital gold”—a hedge against fiat devaluation and centralized monetary systems.

The Convergence of TradFi and DeFi Is Accelerating

The convergence between traditional finance and decentralized finance is no longer theoretical. From tokenized Treasuries to central bank digital currencies (CBDCs), blockchain is reshaping how capital is stored, moved, and deployed.

Projects like BUIDL are a prime example of compliant, regulated DeFi initiatives that blur the lines between old and new finance. Moreover, platforms such as Ethereum and Polygon are hosting these tokenized assets, creating an ecosystem where liquidity, transparency, and programmability are the new standard.

This convergence is expected to drive a new wave of capital inflows, particularly from sectors previously skeptical of crypto due to volatility and compliance concerns.

What This Means for Retail and Institutional Investors

For institutional investors, the rise of tokenized treasuries represents a new frontier of yield generation and capital efficiency. These products offer all the benefits of U.S. government bonds—with the added upside of blockchain’s security and flexibility.

Retail investors, on the other hand, benefit from greater access and reduced friction, as DeFi protocols increasingly support fractional ownership of real-world assets. In essence, tokenization democratizes opportunities that were once reserved for large funds and accredited investors.

What’s Next for Crypto Markets in 2025

Looking ahead, the growth in tokenized financial instruments and the continued institutional interest in Bitcoin point toward a structurally bullish phase for the crypto market. With regulations becoming clearer in major economies and technological improvements lowering the barrier to adoption, blockchain is entering its next chapter—one that involves real-world integration at scale.

The fusion of blockchain with regulated, real-world finance is not just a trend—it’s a paradigm shift. Investors, developers, and regulators must now work together to shape a system that retains the best of both worlds: the trust of TradFi and the innovation of DeFi.