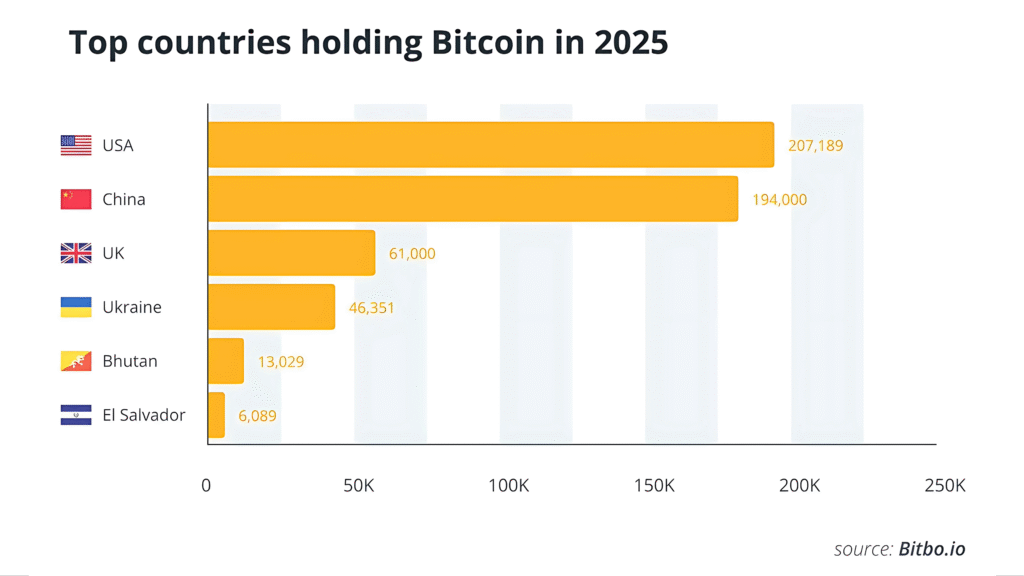

In 2025, sovereign Bitcoin accumulation is becoming a strategic move across the globe. According to recent data from Bitbo.io, the United States leads the pack with 207,189 BTC, followed closely by China with 194,000 BTC. The United Kingdom holds around 61,000 BTC, Ukraine owns 46,351 BTC, and surprisingly, Bhutan and El Salvador also make the list with 13,029 BTC and 6,089 BTC, respectively.

Which Countries Hold the Most Bitcoin in 2025?

While the U.S. and China are expected players on this list, smaller nations like Bhutan have been quietly mining and accumulating Bitcoin as part of their national strategies. For investors, this surge in state-level adoption signals that Bitcoin is no longer just a speculative asset—it’s becoming a sovereign digital reserve.

United States: Bitcoin as a Strategic Reserve

The United States has transformed its relationship with Bitcoin. In 2025, the U.S. officially designated Bitcoin as part of its Strategic Digital Asset Reserve, primarily composed of assets seized during criminal investigations. This bold move—announced via an executive order—positions Bitcoin alongside traditional financial reserves like gold and Treasury bonds. With ETFs and institutional platforms embracing BTC, America’s move reflects a clear intent: Bitcoin is here to stay in the financial system.

China: From Ban to Backdoor Accumulation

Despite a well-documented crypto ban, China is the second-largest holder of Bitcoin in 2025. Much of this stash reportedly comes from law enforcement seizures during major fraud investigations, particularly the infamous PlusToken scheme. The government has remained silent about its long-term plans for these holdings, but market watchers believe Beijing could leverage its BTC holdings geopolitically—or quietly liquidate during market peaks.

What makes this even more intriguing is China’s recent pivot toward stablecoins. While still restricting retail crypto activity, top-level regulators in Shanghai are now openly exploring yuan-backed stablecoins. This suggests China is re-entering the digital currency space through its own terms.

Stablecoin Strategy: China Eyes Yuan-Backed Digital Finance

In July 2025, a groundbreaking development emerged: Shanghai officials began pushing for the launch of yuan-backed stablecoins, marking a significant shift in China’s digital currency strategy. The People’s Bank of China (PBOC) has been cautious, but the conversation has evolved. Large Chinese tech firms like JD.com and Ant Group are lobbying for the creation of stablecoins to support cross-border trade, digital commerce, and blockchain-based settlements.

Analysts predict that if China introduces a regulated yuan stablecoin through Hong Kong, it could bypass capital controls and challenge the dominance of U.S. dollar-backed stablecoins like USDT and USDC—creating a powerful new rail for Asian markets.

Why These Trends Matter for Crypto Investors

The growing Bitcoin reserves among countries—especially by powerful economies—indicate a larger trend: institutionalization of crypto assets. When sovereign nations treat Bitcoin as a strategic reserve, it legitimizes the asset class and encourages long-term adoption by other governments, banks, and financial institutions.

At the same time, China’s movement toward stablecoin innovation—even under strict crypto restrictions—could introduce new global liquidity flows and a multipolar digital currency system. For investors, this means it’s time to monitor not just crypto prices, but policy shifts in major markets.

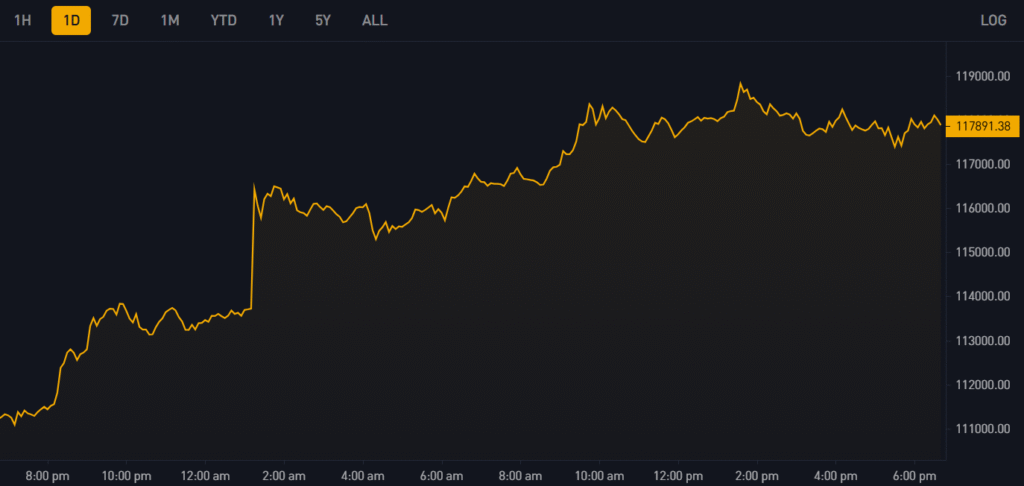

Bitcoin Breaks $116K: What’s Fueling the Surge?

As of mid-2025, Bitcoin has soared past the $116,000 mark, driven by a confluence of factors:

- Strong on-chain fundamentals

- Growing ETF adoption

- Institutional inflows from global markets

- A narrative shift from speculation to digital gold

The surge reflects how Bitcoin is now seen as a macroeconomic hedge, similar to gold—especially in times of inflation, currency devaluation, or geopolitical uncertainty.

Takeaways for Crypto Enthusiasts & Institutional Investors

Bitcoin is now a government-level asset. The U.S., China, and UK are leading the way in accumulation, with smaller nations catching up.

China’s crypto stance is evolving. While Bitcoin trading remains banned, yuan stablecoins could provide a regulated entry point into the decentralized finance space.

The era of multipolar crypto finance is here. With the digital yuan, yuan-backed stablecoins, and Western ETFs all in play, we’re entering a new chapter in global finance.

Disclaimer: All content published by Crypto Pro Live (CPL) is intended solely for informational and educational purposes. It does not constitute financial, investment, or legal advice. While we strive for accuracy and reliability, CPL assumes no responsibility for any financial decisions, losses, or actions taken based on the information provided. Readers are encouraged to conduct thorough research and seek professional guidance before making investment choices.

One thought on “Top Countries Holding Bitcoin in 2025 Revealed”