In a move that has sent shockwaves through global financial markets, President Donald Trump announced the imposition of substantial tariffs on major U.S. trading partners, including China, Mexico, and Canada. Effective April 9, these tariffs encompass a 10% baseline levy on all imports, with heightened rates such as a 54% tariff specifically targeting Chinese goods. This aggressive trade stance has ignited widespread economic repercussions, notably impacting the cryptocurrency market.

Immediate Impact on Cryptocurrency Markets

The announcement triggered a significant downturn in the cryptocurrency sector. Bitcoin (BTC), the leading digital asset, experienced a sharp decline, plummeting below the $100,000 mark to approximately $92,000—a level not seen since early January. This decline was mirrored across the crypto landscape, with Ethereum (ETH) dropping 24% to $2,300, and other altcoins like XRP and Dogecoin (DOGE) suffering losses exceeding 30%.

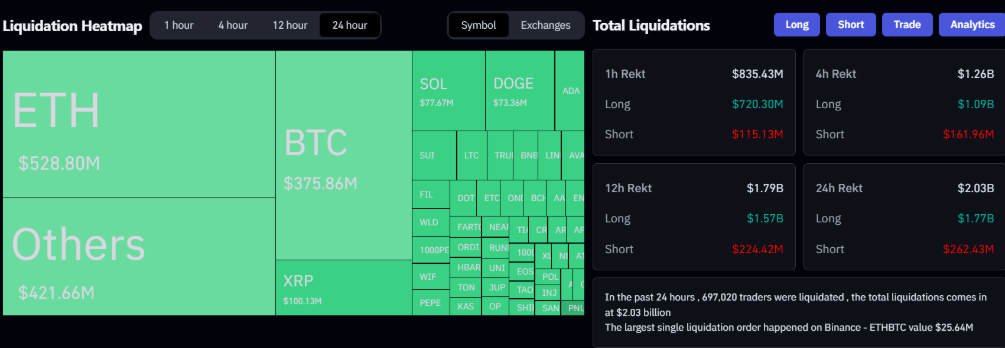

This market turbulence led to over $2 billion in liquidations within a 24-hour period, as leveraged positions were forcefully closed due to the precipitous price drops. Analysts attribute this sell-off to investor concerns over escalating inflationary pressures stemming from the tariffs, which could prompt the Federal Reserve to maintain higher interest rates, thereby diminishing the appeal of riskier assets like cryptocurrencies.

Analyst Perspectives: Inflation and Crypto Volatility

Financial experts warn that the newly imposed tariffs could exacerbate inflation, as increased import costs are likely to be passed on to consumers. This scenario presents a complex landscape for cryptocurrency investors. On one hand, heightened inflation could erode the purchasing power of fiat currencies, potentially enhancing the appeal of decentralized assets like Bitcoin as a hedge. Conversely, persistent inflation may lead to sustained high-interest rates, which traditionally dampen enthusiasm for speculative investments, including cryptocurrencies.

Nick Forster, founder of DeFi derivatives protocol Derive, highlighted the potential for continued market volatility:

We’re already seeing signs of heightened market volatility, as BTC’s 30-day implied volatility has risen by 4% to 54% in the wake of these tariffs and the broader economic uncertainty. We expect this volatility to persist as more negative catalysts likely unfold in the coming weeks.

Global Trade Tensions and Cryptocurrency Market Sentiment

The tariffs have intensified global trade tensions, with affected nations preparing retaliatory measures. Canada announced matching 25% tariffs on $155 billion of U.S. goods, while Mexico and China have signaled potential countermeasures. This escalation contributes to a climate of economic uncertainty, which historically influences investor behavior in the cryptocurrency market.

Pav Hundal, lead analyst at Australian crypto exchange Swyftx, emphasized the prevailing uncertainty:

The fact is we are just entering a period of unprecedented political support for crypto and there is a huge degree of uncertainty around how the tariff war will play out.

Potential Long-Term Implications for Cryptocurrencies

While the immediate reaction in the cryptocurrency market has been negative, some analysts foresee potential long-term benefits. Jeff Park, head of alpha strategies at Bitwise Asset Management, suggested that the tariffs could inadvertently create favorable conditions for Bitcoin:

This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming… The financial war unravels sending Bitcoin violently higher.

Park’s analysis implies that a weakened U.S. dollar resulting from trade conflicts could drive both domestic and international investors toward Bitcoin as a store of value, potentially propelling its price upward in the long term.

President Trump’s recent tariff implementations have introduced significant volatility into global financial markets, with the cryptocurrency sector experiencing pronounced effects. The immediate downturn reflects investor apprehension regarding inflation and economic instability. However, the evolving trade landscape may also set the stage for cryptocurrencies like Bitcoin to emerge as alternative assets amid fiat currency fluctuations. As the situation develops, market participants will closely monitor policy shifts and their broader economic impacts, underscoring the intricate interplay between geopolitical events and the digital asset ecosystem.